On June thirteenth, several corporations updated their Solana ETF submissions on the US Securities and Exchange Commission (SEC). The changes aim to reply the sooner questions of the SEC. However, the supervisory authority has no hurry to approve it, in accordance with a source that spoke to Reuters.

The updated submissions got here from several applicants, including Canarys Marinade Solana ETF, the 21shares Core Solana ETF and the Bitwise Solana ETF.

These corporations hope to start out hand-handed funds that pursue the value of the Solana token. While the changes are purported to drive the method, there continues to be no timeline, when – or if – the SEC approves it.

X suspends several Solana projects, including Pump.fun, for API abuse and political concerns

On June seventeenth, several crypto projects based in Solana lost access to their official X accounts. The suspended accounts include meme token platform pump.fun, gmgn, Bullx and Eliza OS. X gave no public explanation for the bans and let the crypto community confused.

The most discussed theory is concentrated by pump. According to reports, the platform has scraped off data without wearing out for the paid developer access from X. This would violate the API terms of X and possibly trigger suspensions.

Pump.fun account suspension. Source: x

Some unconfirmed reports also indicate that other accounts under the identical umbrella could have hosted inappropriate livestreams. Although not verified, these claims have increased the general public examination of the affected platforms.

Pump.fun has already been criticized to enable fraud token. X users have claimed that “99% of the token carpets launched on pump are.” In March 2025, the platform geo-blocked Indian users suddenly, probably as a result of the local crypto regulations.

The prohibitions are concerned in regards to the way forward for Memecoins and decentralized launch pads in Solana. Pump.fun helped this 12 months's Memecoin wave, but its sudden removal of X can shift users to more regulated platforms. Solana's confidence within the Meme -token -Inficken infrastructure appears to be weaker.

Solana forms bullish triangle, eyes 82% rally towards 272 US dollars

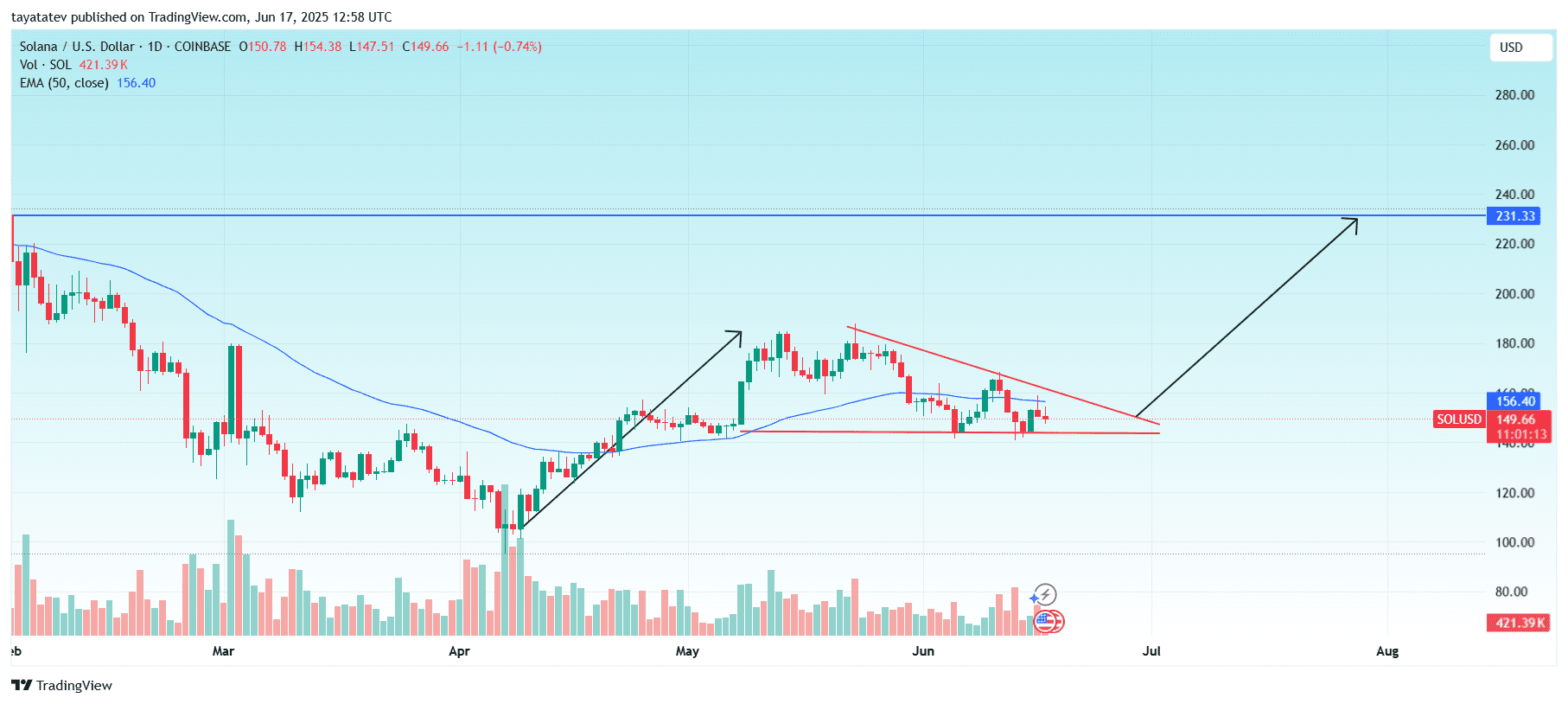

Solana (Sol) has created a bullish triangular pattern within the every day table. The diagram shows the token trade at $ 149.66 and consolidates inside a narrowing area that’s formed by a horizontal line of support and a descending resistance line.

Solana bullish triangle pattern projection. Source: Tradingview

Solana bullish triangle pattern projection. Source: Tradingview

A bullish triangle – also referred to as bullish symmetrical triangle – forms when the value campaign creates lower heights and at the identical time maintains a stable level of support. This structure shows that sellers lose dynamics, while buyers proceed to defend a key price level. If the triangle is committed, pressure builds up. An outbreak above the upper trend line often triggers a robust upward movement.

When Solana confirms an outbreak over the resistance of the triangle, the pattern indicates a possible rally of as much as 82% from the present price. Based on this projection, Sol could increase from $ 149.66 to almost 272 US dollars.

The volume in the course of the pattern has decreased, which inserts the standard behavior of the triangular formation. A breakout, accompanied by a volume mirror, would probably confirm the move.

From June seventeenth, Sol shall be $ 156.40 under the 50-day EMA. A transparent movement about each the EMA and the triangular resistance would signal the strength and trigger the bullish goal zone.

MacD signals weak dynamics for Solana

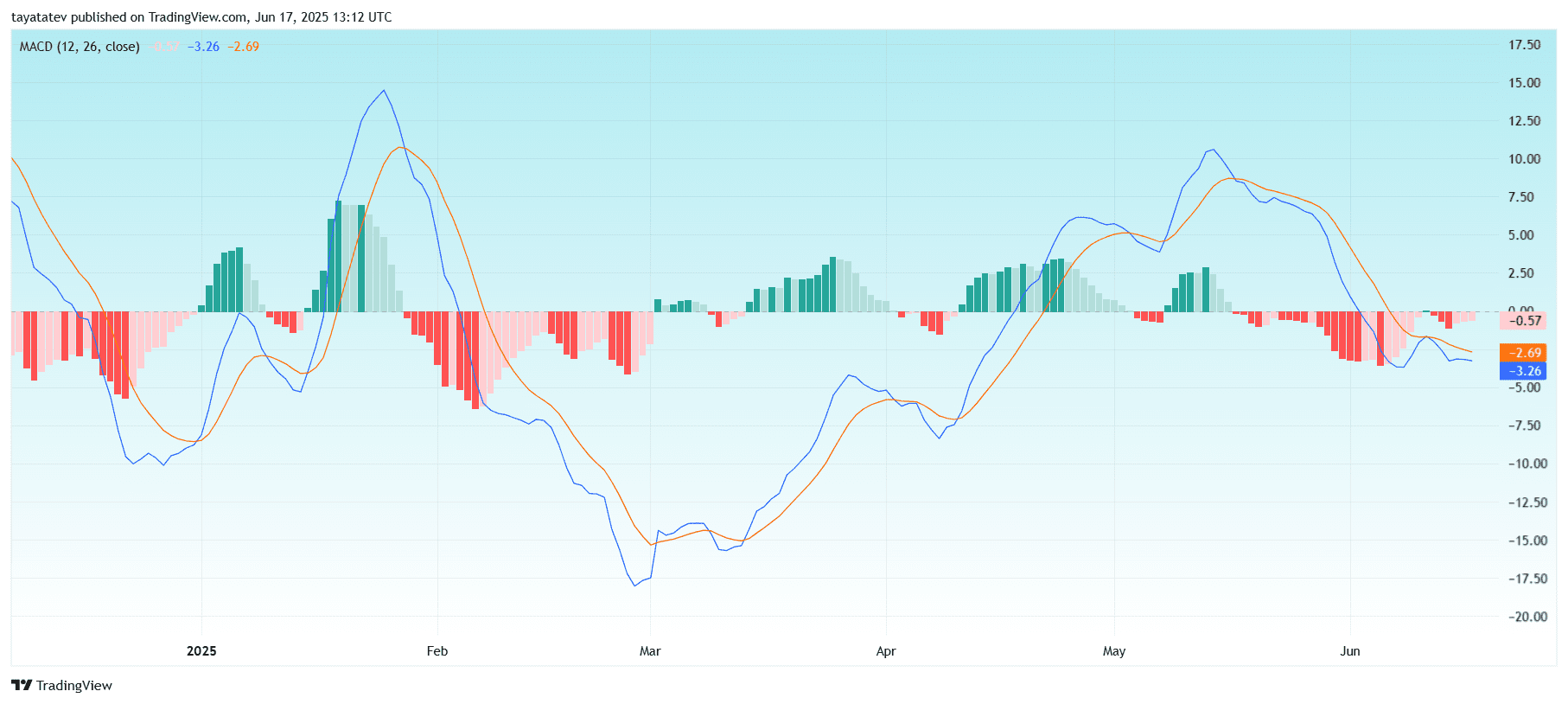

From June 17, 2025, the MacD indicator for Solana (Sol) will show a weak impulse without confirmed bullish reversal. The MacD line is at –3.26, while the signal line is somewhat higher at –2.69. Both remain below the zero line and ensure that the downward impulse continues to be energetic.

Solana MacD impulse weakens the road below zero. Source: Tradingview

Solana MacD impulse weakens the road below zero. Source: Tradingview

Although the histogram with the newest bar began to shrink at –0.57, this shows only a slight reduction in sales pressure. A bullish crossover has not occurred, which suggests that the MacD line has not yet been crossed over the signal line. In this case, the diagram doesn’t confirm upward trend. The setup still leans Bärisch, and a transparent transfer above the signal line is required to support the case for an outbreak.

Solana RSI hovers under 50 with weak dynamics

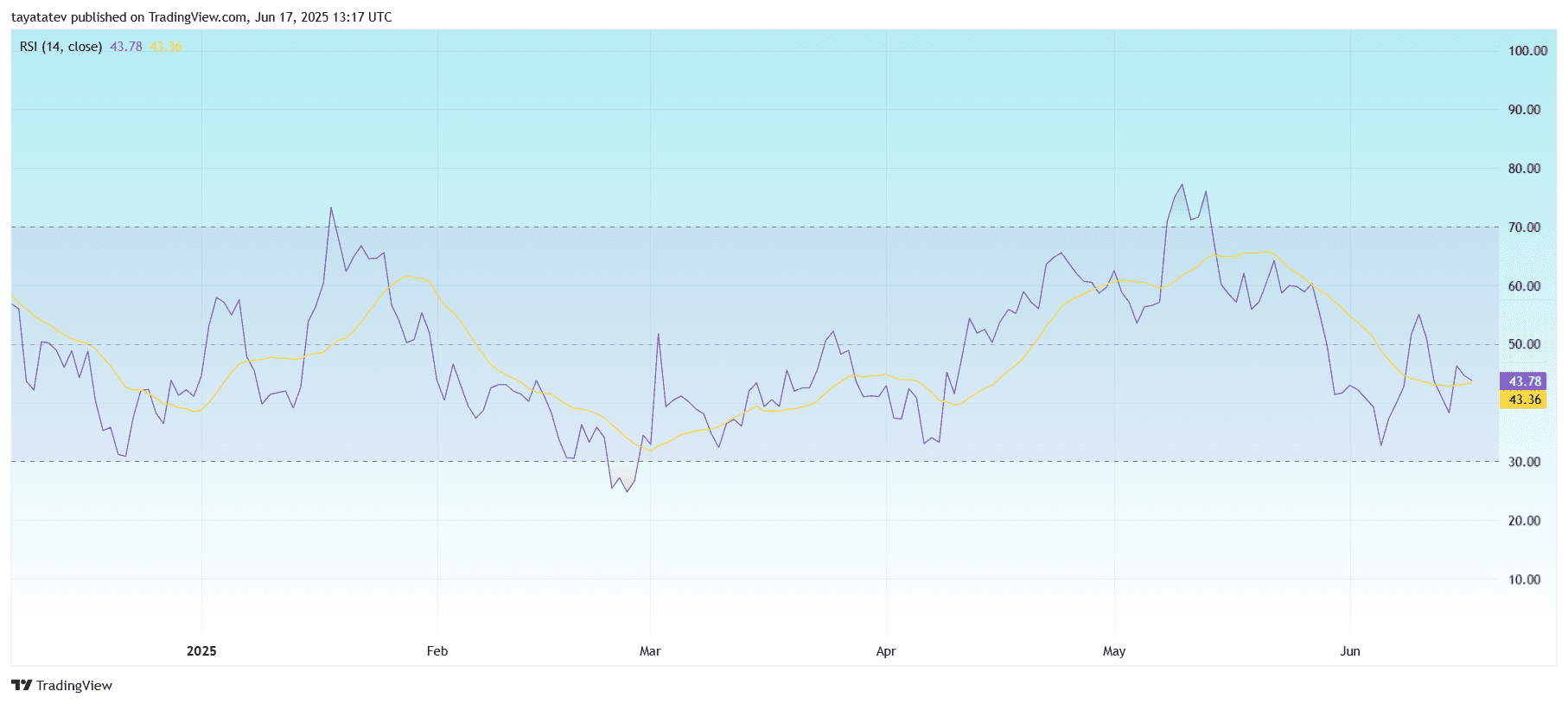

The relative starching index (RSI) for Solana (SOL) currently reads 43.78 with its 14-day easy moving average of 43.36. The RSI is an impulse indicator that measures the speed and size of the newest price movements to evaluate whether cryptocurrency is overbought or oversized. The standard -rsi scale ranges from 0 to 100. The values over 70 typically signal over covered conditions, while the values under 30 indicate oversold conditions.

Solana RSI hovers under 50 with weak dynamics. Source: Tradingview

Solana RSI hovers under 50 with weak dynamics. Source: Tradingview

From now on, Solanas RSI is situated under the neutral center of fifty. This indicates that the asset is in a bear or weakening impulse phase. If the RSI stays within the range of 30 to 50, it often reflects consolidation or downward pressure in the value effect. Since the RSI and its sliding average move to the side and remain close together, this confirms the dearth of a robust directional impulse.

There can be no visible bullish or bear divergence between the RSI and the value card. Deviations often provide early signals of a trend reversal, but on this case each indicators proceed to match the weak price movement.

If RSI falls towards 30, the token can enter the oversized zone. This level has attracted some interest in purchase previously, but the present measurements show that Solana still hovers in a neutral to warehouse area with out a clear signal for a reversal.

Direction movement index shows mixed trend signals for Solana

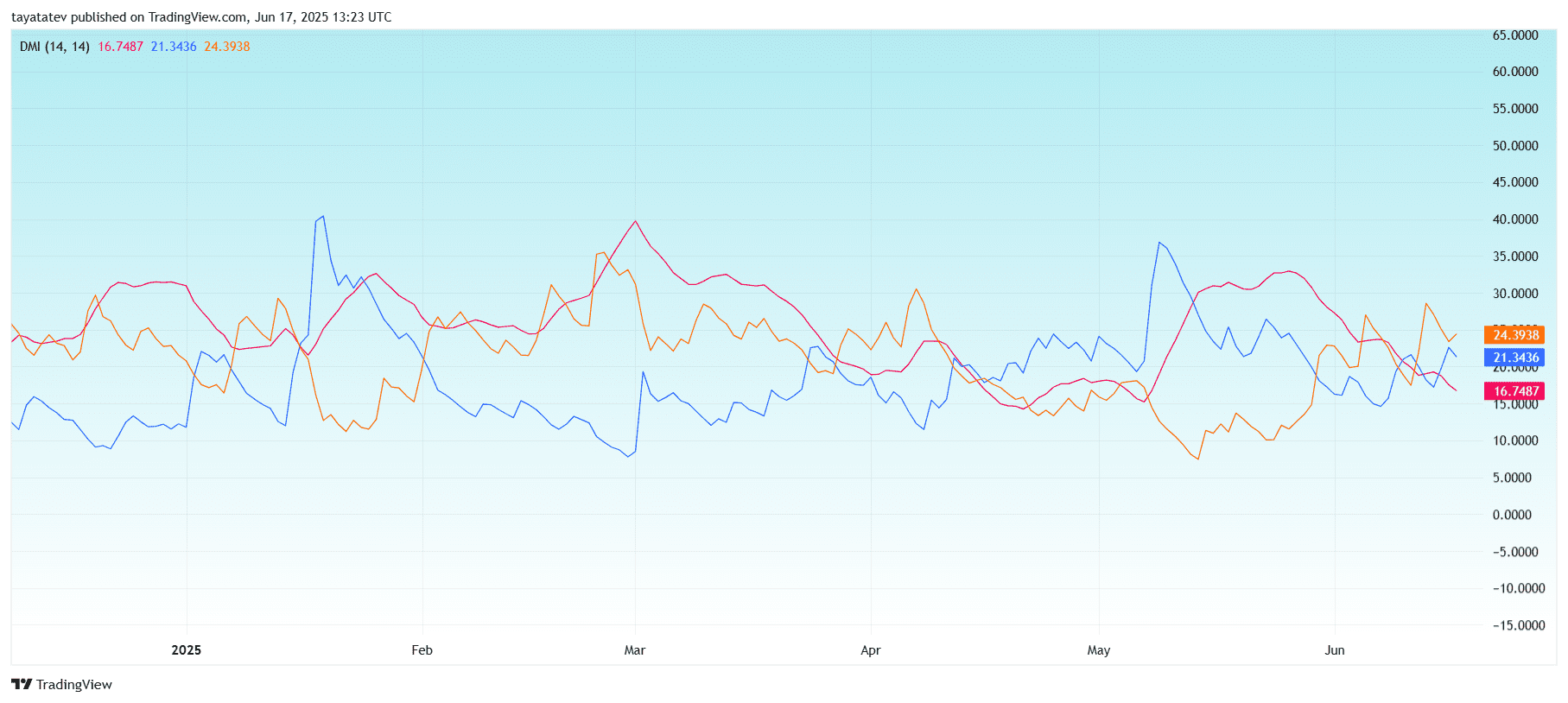

The directional movement index (DMI) for Solana (SOL) uses three lines to judge the trend strength and direction: the positive direction indicator (+di), the negative direction indicator (–di) and the common direction index (ADX). These are applied here with the next values:

-

+From (orange line): 24.39

-

–Di (blue line): 21.34

-

Adx (red line): 16.74

The +DI is currently above the –di, which often shows a Bullish print. However, the ADX stays under 20, which indicates that the continued trend is weak or not well established. The ADX measures the trend strength whatever the direction. Measured values under 20 often indicate a scarcity of trend or chopped market behavior.

Solana DMI shows a weak trend with bullish prejudices. Source: Tradingview

Solana DMI shows a weak trend with bullish prejudices. Source: Tradingview

In the past few weeks, the +DI and –DI have been exceeded several times and have shown indecisiveness and movement between buyers and sellers. At the moment, the buyers have a light-weight edge, but without strong ADX support, every direction movement lacks confirmation.

In order for the signal to develop into stronger, ADX would need to rise above 20–25, ideally, while +Di stays above –di. Until then, the value campaign of Solana can proceed sideways or experience short -term fluctuations without sustainable movement