Pump.fun, the Memecoin launchpad, which dominates the Onchain activity of Solana, sold around 4.1 million SOL -tokens value 741 million US dollars, just a couple of days before its official suspension of X.

According to Lookonchain, the platform from May 19, 2024 led several transactions in several transactions from May 19, 2024 at a mean price of $ 180 per SOL.

Source: Lookonchain/X

Among the transfers, 264,373 Sol were exchanged in USDC directly around $ 41.64 million at a price of $ 158, while a lot of the 3.84 million Sol was sent to octopuses, which indicates a possible liquidation. With Memecoin projects which have already been checked, this sort of treasury -dump -confidence problems and the pressure on the value of Sol.

Repeated Ministry of Finance transfers to centralized exchange comparable to octopus signal gain, which the operators of the platform can win, as an alternative of reinvestment to the Solana ecosystem. The shift triggered a barical mood, especially in a broader downturn into Solana's price campaign and social sums.

Source: Alva app

Source: Alva app

Despite SOL sales, Solana corporations win traction

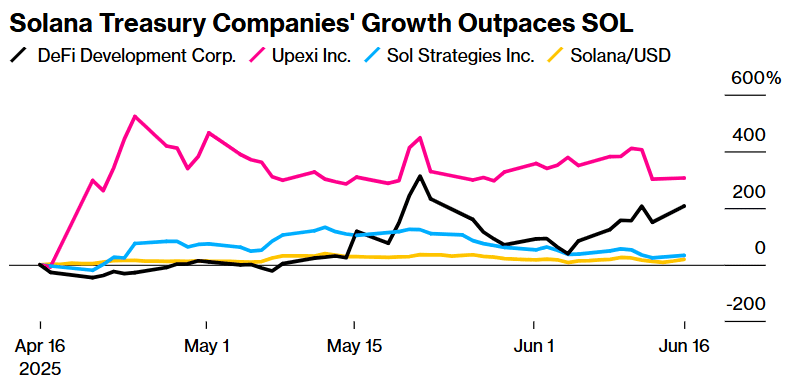

Despite Pump.Fun's Exit Wave, the financial corporations based in Solana still gain traction. A Bloomberg diagram shows that corporations like Defi Development Corp. and UPEXI Inc. Expose growth from so and intensify institutional trust in Solana as an extended -term asset.

The growth of Solana Treasury Companies passes. Source: Bloomberg

The growth of Solana Treasury Companies passes. Source: Bloomberg

Bloomberg reports that Cantor Fitzgerald -Analyst Thomas Shinske recently emphasized in a note that Sol could ultimately exceed finance company within the appeal to finance, because of its low fees, quick speeds and incentives to the financial company.

These often publicly listed corporations can invest capital with a bonus and reinvestment within the Sol ecosystem and offer investors in Solana commitment without keeping the tokens directly.