The native token hype from Hyperliquid has reached open rates of interest for Futures contracts of two.06 billion US dollars. This presents Hype in front of Dotecoin (Doge), which is 1.83 billion US dollars and just behind XRP, with $ 4.12 billion. Hype is now in fifth place worldwide under cryptocurrencies through futures open interest and only follows Bitcoin, Ethereum, Solana and XRP.

TOKE CUSTOMPLY Supports the Demandhyperliquid market starts on-chain stock index futures

Hype future open interest. Source: Coinglass

Open interest measures the entire value of the Open Futures positions. The rise from hype to the highest 5 shows the increasing use of the infrastructure of hyperliquid by dealers and institutions despite its lower market capitalization in comparison with more established cryptocurrencies.

Last week, hyperliquid has processed $ 56.6 billion of everlasting futures trades, which corresponds to 60% of the entire on chain volume from $ 94.3 billion. This makes the protocol because the leading decentralized platform for everlasting derivatives.

TOKEN -REISCHAUSMODEL supports market demand

The Hyperliquid protocol uses 92.78% of the trade fees to purchase the hype back from the open market. This generates over 1 billion US dollars in annual return purchases. These purchases reduce the token offer and at the identical time increase demand.

The platform has also attracted activities of institutional trading corporations and marketmakers. These participants contribute to increased trading volume and a deeper order book liquidity within the layer -1 exchange infrastructure.

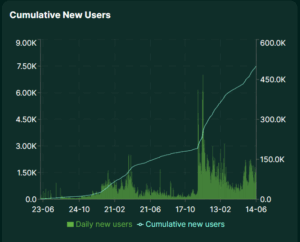

Hyperliquid has also recorded a fast introduction of users because the end of 2024. The cumulative accounts on the protocol rose from lower than 600,000 in mid -June 2025 in October 2024. On just a few days, greater than 7,000 recent bearlings were created.

Hyperliquid cumulative recent users. Source: Hyperliquid statistics

Hyperliquid cumulative recent users. Source: Hyperliquid statistics

The total value of the protocol (TVL) of the protocol also increased strongly – in keeping with Defillama of lower than $ 450 million in April to $ 1.86 billion until June 16. This corresponds to a rise of 311% in two months.

Several decentralized financial protocols were launched within the hyperliquid chain of hyperliquid. The Felix credit platform has exceeded cumulative loans of $ 100 million. The curve finance has also used liquidity pools within the chain and increased the protocol activity and the range of ecosystems.

These integrations support a growing on chain economy and proceed hyperliquid as a basic layer for decentralized derivatives and defi applications.

Hyperliquid starts on-chain stock index futures

On June 12, Hyperliquid began with public tests from Futures products that were certain with the S&P 500 and Nasdaq -Mini indices. These contracts are integrated directly into the above -average chain and work without an intermediary.

This is one in every of the primary traditional financial instruments offered via a decentralized platform. The contracts use live price data and run directly on the Hyperliquid blockchain.

Hyperliquid can also be preparing to decentralize key functions by the upcoming hip-3 government proposal. The design outlines plans for the introduction of permissionless and market position. If they’re approved, users can bring recent markets onto the market and earn protocol premiums with no need central approval.