PEPE DMI signals a weak trend with a light-weight bullish preload

On June 15, 2025, the directional movement index (DMI) showed mixed signals within the 4-hour PEPE/USDT diagram. The orange positive directional indicator (+di), which was crossed over the blue negative direction indicator (−di), which indicates a slight bullish pressure. The +DI was 21.38, while the −di remained lower after 18.49.

Pepe Directional Movement Index (DMI) 4h. Source: Tradingview

Despite the crossover, the red average direction index (ADX) printed 21.10, which signals that the whole trend strength stays weak. An ADX measurement value below 25 typically signifies that the market is missing a robust direction, no matter whether bulls or bears.

This structure points to a possible shift towards bullish impulse, but not enough strength has occurred to verify a solid trend. If ADX now not increases over 25 within the upcoming sessions, pepes can remain the other way up or don’t maintain an outbreak. The DMI data support consolidated consolidation unless the acquisition pressure doesn’t increase significantly.

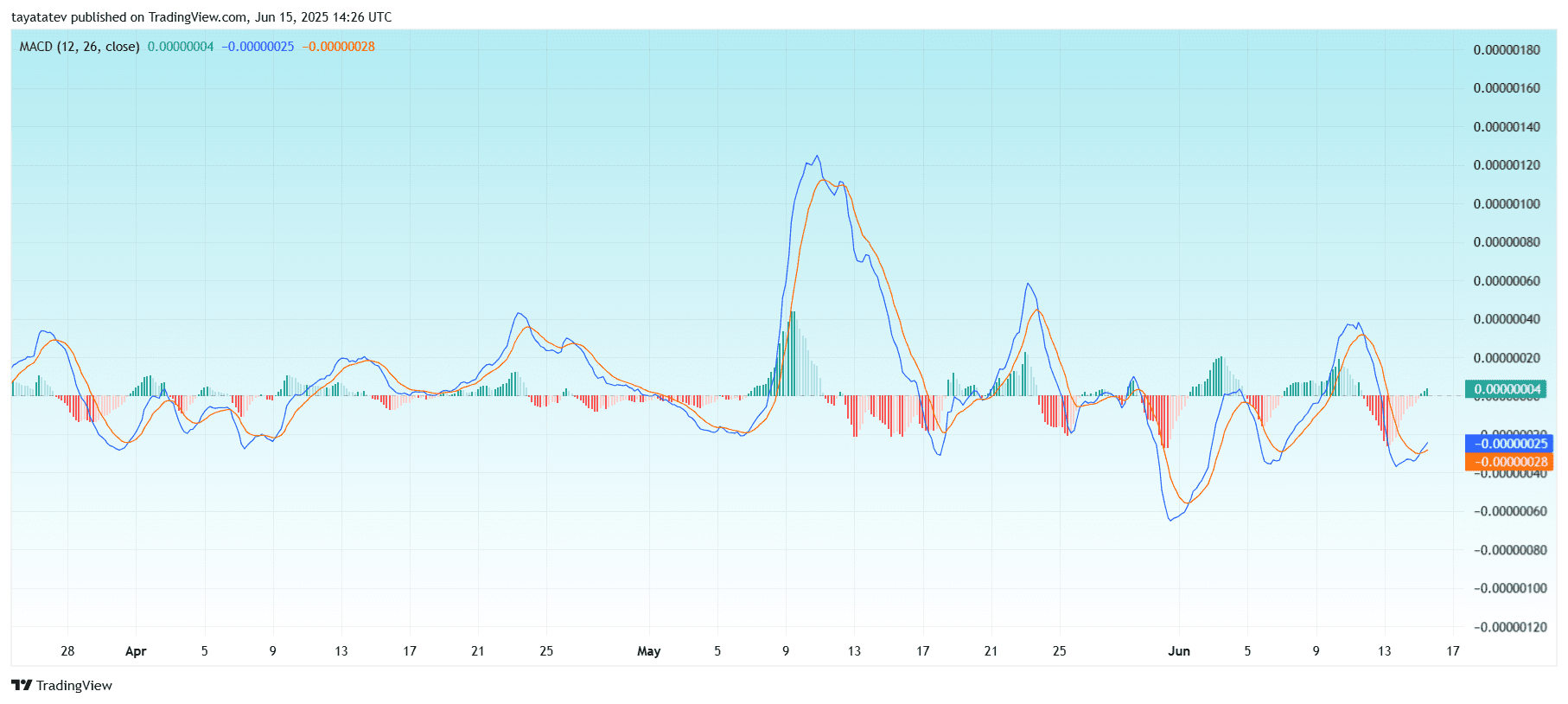

Pepe macd flat shaft when the impulse weakens

The PEPE/USDT-4-hour diagram showed signs of trend creation based on the indicator of the sliding average convergence divergence (MACD). The MacD line (blue) read –0.00000025, while the signal line (orange) was near –0.00000028. Both values hovered slightly below zero.

Pepe sliding average convergence divergence (MacD) 4h. Source: Tradingview

Pepe sliding average convergence divergence (MacD) 4h. Source: Tradingview

The minimal gap between the 2 lines reflects the weak impulse in each directions. While a bullish crossover took place firstly of this month, the most recent flattening indicates within the short -term trend towards the fading of the strength.

The histogram beams, which measure the space between the MacD and signal line, have almost disappeared. This visual note shows a lack of impulse and the dearth of a dominant trend in the meanwhile.

If the MACD line exceeds the signal line again with increasing histogram beams, a brand new bullish phase can begin. Without increasing dynamics, nevertheless, the MacD structure indicates a neutral and undecided marketplace for Pepe.

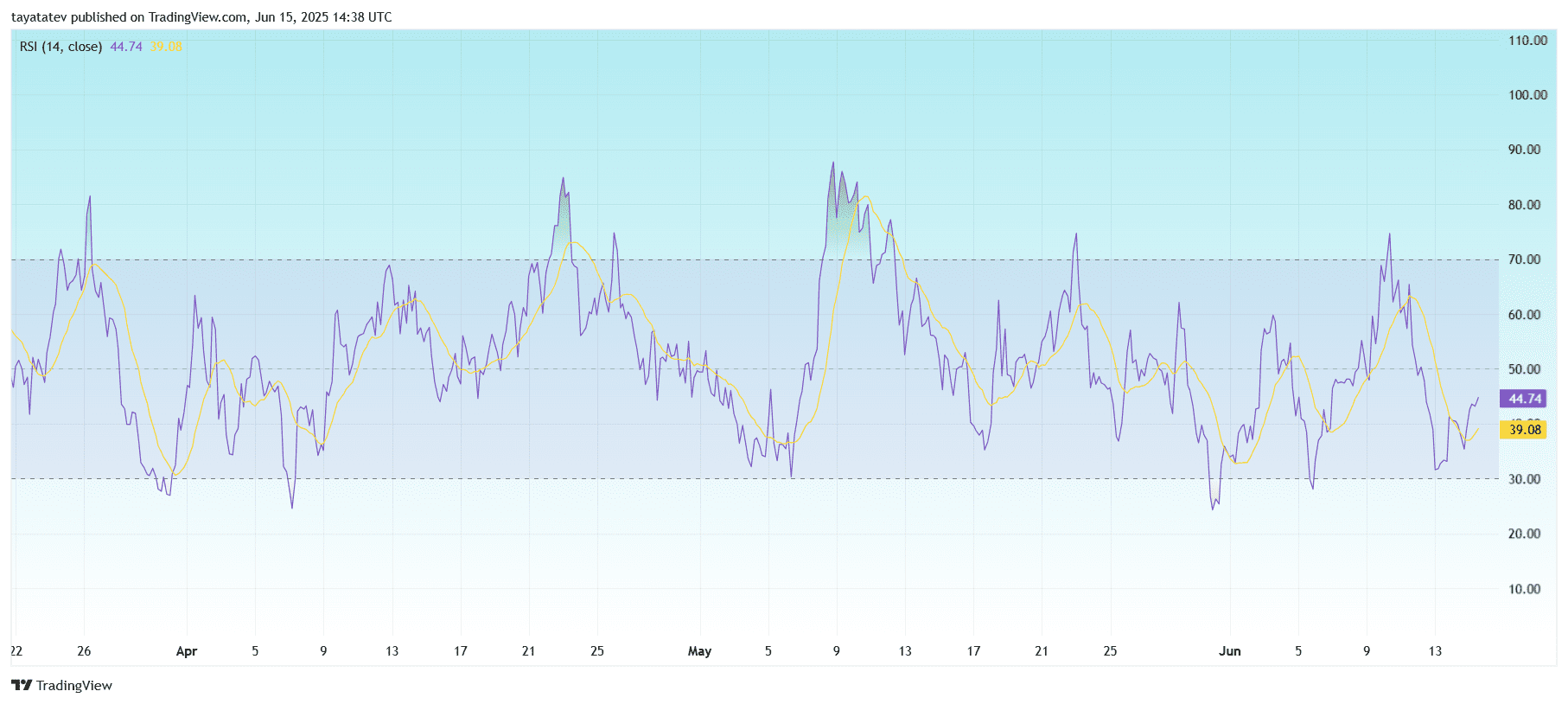

Pepe RSI shows a weak rest of just about overold zone

From June 15, 2025, the relative strength index (RSI) for PEPE/USDT on the 4-hour diagram 44.74, a bit above the neutral 50 level. The RSI was recently picked up from a deep -riot near 30, which borders on the oversized threshold.

Pepe Relative Starking Index (RSI) 4h. Source: Tradingview

Pepe Relative Starking Index (RSI) 4h. Source: Tradingview

The yellow moving average from RSI was 39.08 and showed a delay within the recreation of the impulses. RSI, which climbing above this average, shows an upward price movement, but not enough to verify a robust Bullic impulse.

During the whole diagram, RSI has consistently didn’t obtain movements above the 70 zone, which implies that the dearth of overbought strength occurs. At the identical time, frequent burglaries within the direction of the 30 stage show a repeated weakness without forming a robust trend.

Since RSI decreases under 50 and the volatility, the present signal indicates a weak upward movement without confirming a continued purchase. A set break over 50 can be required to signal a possible shift of the impulse. Until then, RSI proposes a limited strength behind the present price.

Pepe Tops Lunarcrush Altrank, while Memecoins expand the market range in 2025

On June 14, 2025, Pepecloy was primary within the Lunarcrush -Altrank – a metric that pursues social media activities and price performance in comparison with Bitcoin. This increase shows the growing role of memoins within the design of the crypto landscape through community-driven impulse, humor and viral influence.

Pepes lead signals a wider trend. Other Memecoins also achieved traction. Hype took second place, driven by strong exchange lists and bullish dynamics. Kaito followed in third place, reinforced by the progress of the integrations for artificial intelligence and the growing support of developers.

Lunarcrush data show that investors are increasingly moving from traditional foundations to social engagement. While the value and market capitalization remain vital indicators, retail feeling now plays a stronger role in influencing crypto visibility and acceptance.

The rating not only favored memoins. There was also strong for supply base. Bitcoin Cash (BCH) secured fourth place, supported by rising peer-to-peer transactions and using payment service providers. Internet Computer (ICP) on the fifth showed continued developer activities and web3 development progress. Litecoin (LTC) experienced profits from the growing use and integration of payment chains into payment systems in sixth place.

Celestia (TIA) also appeared in the highest rankings and reflected the brand new interest in modular blockchain networks. Aero attracted attention based on large network upgrades, and BMT entered the highest ten before his expected governance was published. Ravencoin (RVN), who focused on the tokenization of securities, obtained the demand for conformer asset toking.

Together, these shifts reflect a ripening market. Investors at the moment are balancing social dynamics with practical use. Memecins like Pepe proceed to dominate digital conversations, while infrastructure -oriented tokens are recognized for long -term value. This double dynamic shapes the brand new dynamics within the cryptocurrency area and influences each the adoption trends and project development.