Upbit, a cryptocurrency exchange in South Korea, listed two recent digital assets on – Ravencoin (RVN) and Lagrange (LA) – The platform RVN/KrW trading couple began on June 5, while retail pairs against LA against BTC and USDT were introduced.

Ravencoin (RVN) Price climbs in line with the records of Upbit -Listingla recordings over 100% profit after listings on a very powerful stock exchanges

Ravencoin (RVN) Price climbs after the U -Bit list

Ravencoin (RVN), a blockchain platform developed for the peer-to-peer transmission of digital assets, recorded a pointy price increase in line with the UP-BIT list. Before the announcement, RVN near $ 0.011 was traded with a market capitalization of around 166 million US dollars.

After the KRW trading couple went live, RVN rose to over 0.022 USD in the course of the intraday trade. At the time of writing, RVN is around 0.01676 USD, Shwong is around 48%a 24-hour price increase. The every day trading volume has increased to 461 million US dollars – a rise of over 4,800%.

RVN/USD 1- every day price diagram .. Source: Coinmarketcap

La Records over 100% profit after listings on large stock exchanges

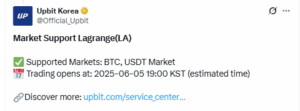

While Lagrange (LA), a supply token issued by LAGRANGE Labs for its zero-knowledge infrastructure protocol, was issued, increased volatility also recorded. Together with the Upbit listing, LA was recently added to platforms resembling Coinbase, Bithumb and Binance Futures, which expanded the range of market administration.

Source: x

Source: x

Before the listing, LA was traded near $ 1.48 with a market capitalization of around 287 million US dollars. It reached an intra -raday high of 1.70 US dollars before retreat. At the press time, LA is about 1.36 USD – with a profit of over 100% within the last 24 hours. The trading volume reached $ 440.7 million and greater than 1,one hundred pcin the identical period.

La/USD Daily Price Chart. Source: Coinmarketcap

La/USD Daily Price Chart. Source: Coinmarketcap

Lagrange Labs carried out a ten% token -airdrop between June 4 and 5 and distributed La -token to authorized users. As in earlier cases-strongly (StrK) and Layerzero (ZRO) -Sind-newly supported tokens often exposed to the printed pressure as soon as they enter the circulation, which contributes to the short-term volatility.

You can even like: South Korea's upbit exchange hit 3 months sanctions, and the volumes drop by 70%

In Las Fall, the overlap between the token prison and a very powerful Exchange listings generated an energetic trade window for recipients. The result was the intraday price movement, which was operated by each the brand new buyers and the sale of airdrops.

Both RVN and LA showed sharp short -term price increases, which were related to their lists in recent markets. Direct KrW access for RVN enabled the participation of regional dealers, while the multiple Exchange offers from LA – including lifted markets – increased speculative trade.

Short -term patterns show that each tokens at the moment are determining recent support levels, especially after the primary rallies. RVN faces a resistance near 0.017 US dollars, while LA tries to stabilize over $ 1.30.