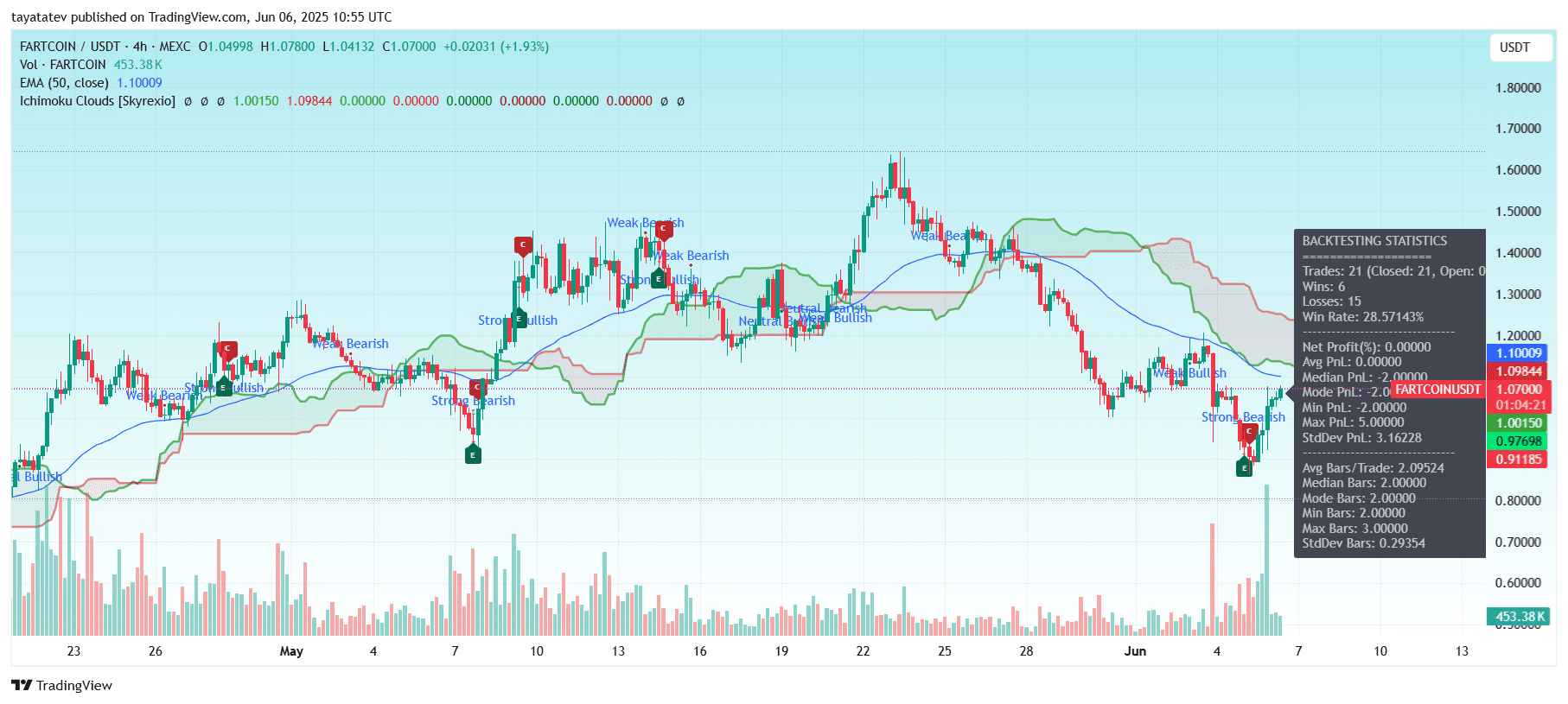

On June 6, 2025, the trading pair Fartcoin to Tether (USDT) formed a falling flag pattern within the 4-hour diagram.

Fartcoin/USDT – falling flag pattern – 4h. Source: tradingview.com

A falling flag pattern appears when the value falls after a powerful upward movement in a channel straightened down. As a rule, it signals a bullish sequel as soon as the value breaks over the upper resistance line of the flag.

If this breakout confirms, the value can increase by 38% of the present level of USD 1.06390 to the projected goal of roughly $ 1,47062.

The diagram shows a transparent breakout attempt above the resistance of the flag. At the identical time, the trade volume has increased, which supports the strength of the move. The volume expansion in the course of the outbreak often confirms the bullish pattern.

In addition, the value is now testing the 50Pro period exponential moving average (EMA), which is currently USD 1.09985. A decisive closure above this dynamic level of resistance would strengthen the case for an additional upward trend.

The previous strong rally formed the flagpole. The consolidation phase in parallel descending trend lines shaped the flag. This structure is aimed toward the classic Bullish Flag setup.

If bulls maintain pressure and press over the EMA, the value within the upcoming sessions can gather on the goal of USD 1.47.

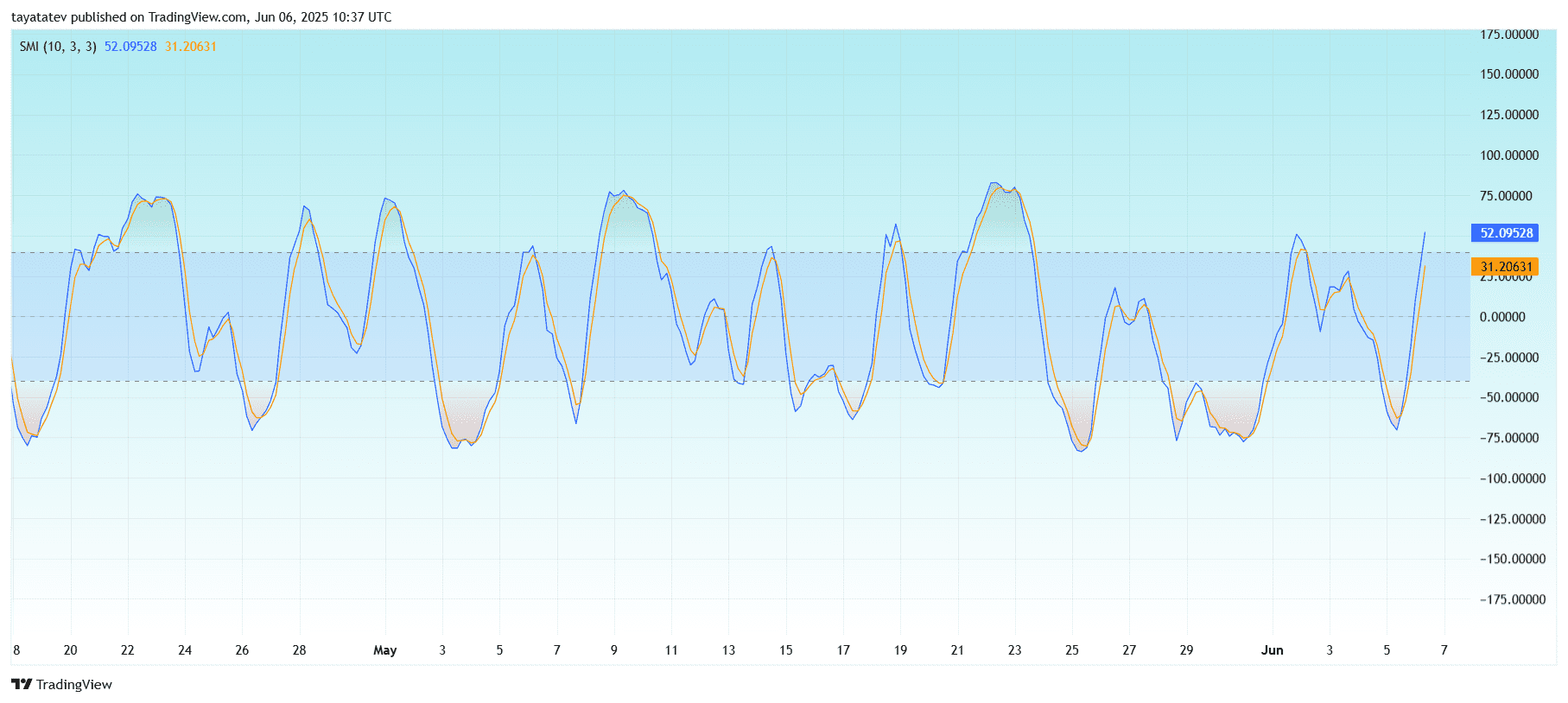

Fartcoin SMI indicator surfaces confirms the bullish dynamics

On June 6, 2025, the 4-hour Fartcoin-to-Tether diagram (USDT) showed a powerful upward movement of the stochastic pulse index (SMI), whereby the blue line (SMI) rose to 52.09 and the orange signal line 31.20.

Fartcoin/USDT – SMI indicator – 4h. Source: tradingview.com

Fartcoin/USDT – SMI indicator – 4h. Source: tradingview.com

The stochastic impulse index (SMI) is a refined version of the normal stochastic oscillator. It measures the ultimate course relative to the middle of the newest high-low range and signals overbought or oversold conditions.

In this diagram, the SMI line has crossed heavily above the signal line below the zone -40. This crossover from a low level typically shows a bullish reversal. The indicator can also be entered within the positive area above the zero line, which reinforces the upward dynamics.

If the SMI continues to rise and stay above the Zone +40, this might confirm the continued purchase pressure. The last crossover and the upward tip are matched with the outbreak from the falling flag pattern within the foremost price diagram and align technical signals across indicators.

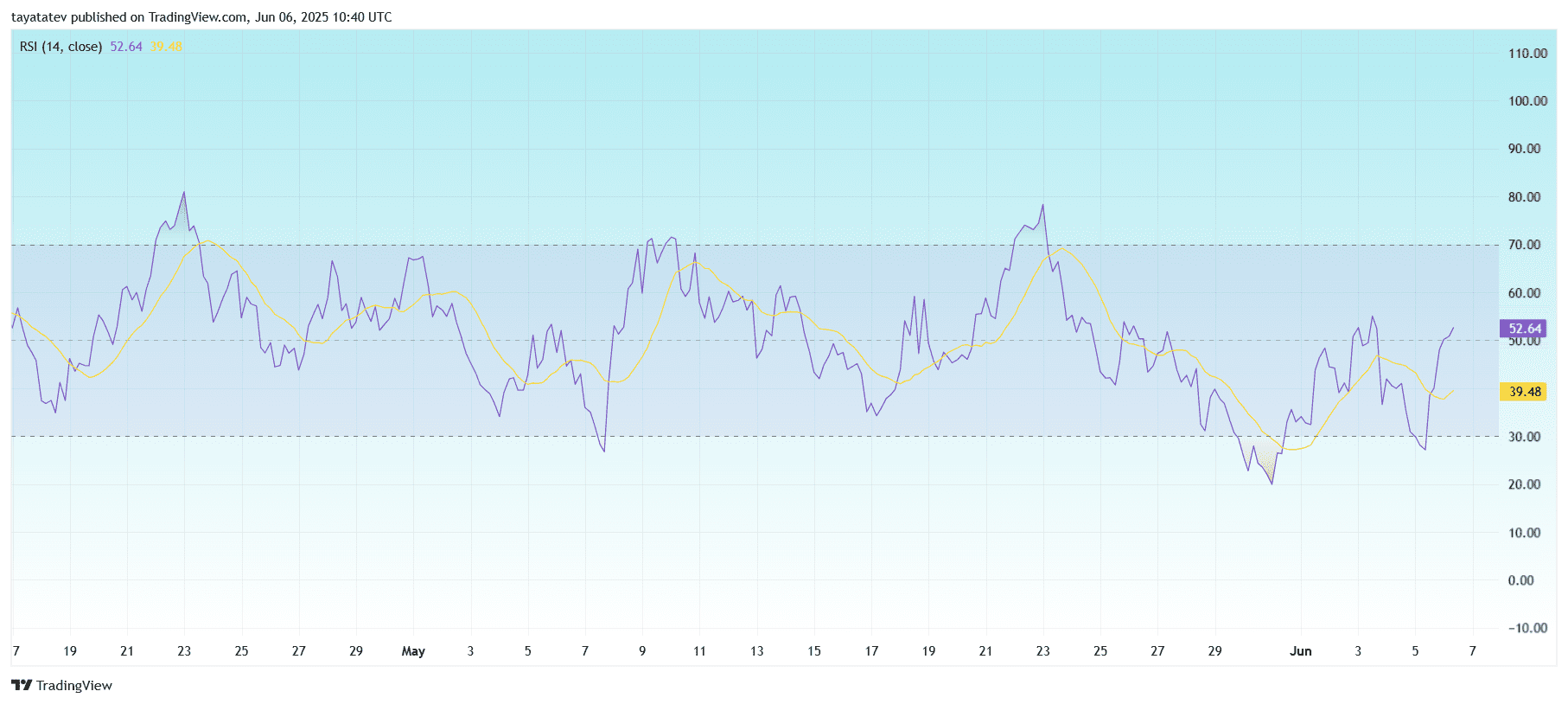

Fartcoin RSI breaks over 50, signals the expansion strength

On June 6, 2025, the relative strength index (RSI) for the Fartcoin-to-Tether pair (USDT) rose to 52.64 on the 4-hour table and moved above its signal line at 39.48.

Fartcoin/USDT – RSI (14) – 4h. Source: tradingview.com

Fartcoin/USDT – RSI (14) – 4h. Source: tradingview.com

The relative strength index (RSI) measures the speed and alter of the value movements on a scale from 0 to 100. Values over 50 indicate bullish impulse, while the degrees below 50 display the bear pressure.

This transition to the bullish area marks the primary clean break over the 50 -May level. The RSI line has also crossed the signal line (yellow), which is usually read as optimistic confirmation.

The RSI previously floated near the oversized area (under 30) after which jumped back strongly. This back rash adds a confirmation to the outbreak in the value card and is aligned with the bullish signal from the stochastic pulse index.

If RSI continues to rise and stay over 50, this might support the further upward movement within the Fartcoin price.

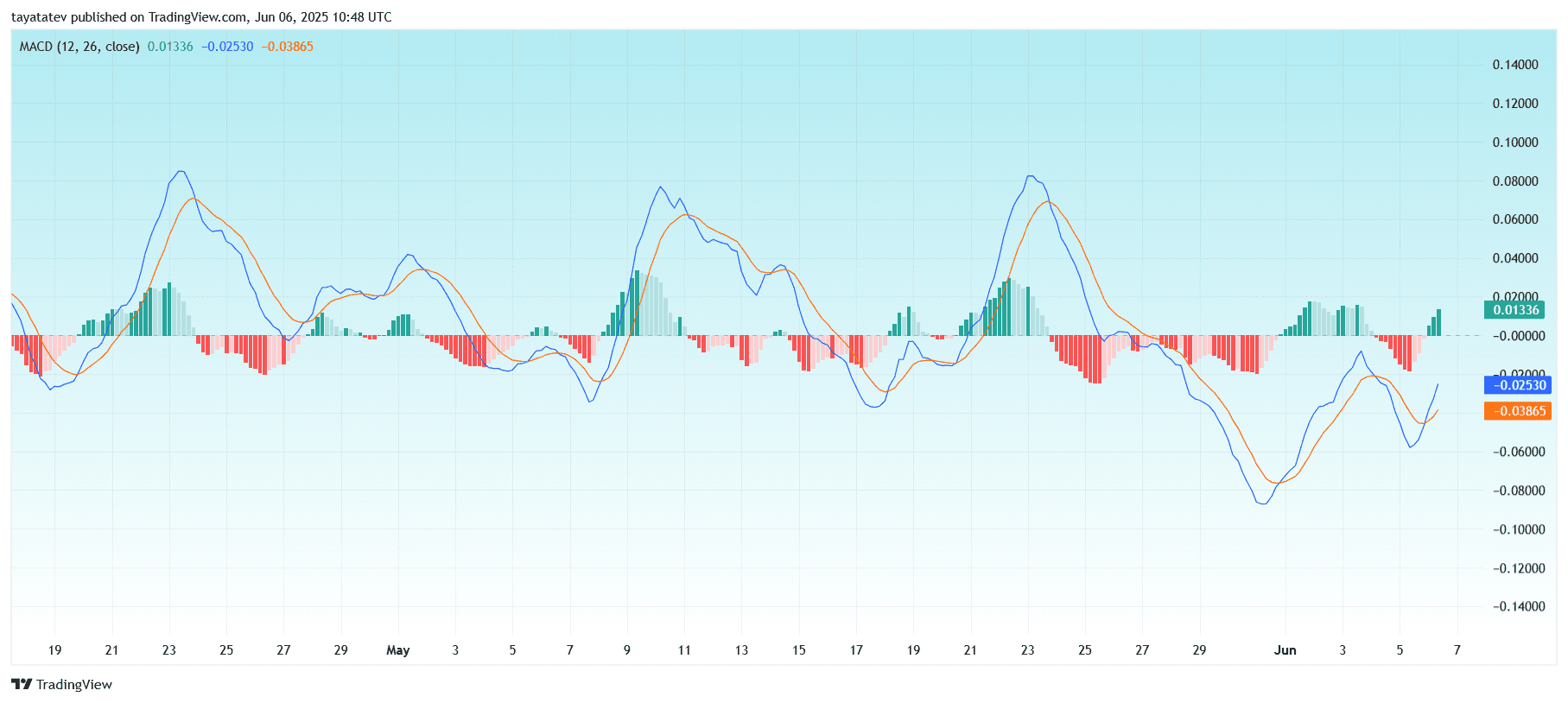

MacD freaked Bullish while the histogram becomes green

On June 6, 2025, the sliding average convergence divergence (MACD) indicator for the 4-hour diagram of Fartcoin to Tether (USDT) signaled a bullish crossover. The MACD line (blue) crossed the signal line (orange) with values at –0.02530 or –0,03865. The histogram has also change into positive at 0.01336, which indicates growing bullish impulse.

Fartcoin/USDT – MACD (12.26.9) – 4HSource: tradingview.com

Fartcoin/USDT – MACD (12.26.9) – 4HSource: tradingview.com

The MACD uses two exponential movable average values typically 12 to 26 and 26 to acknowledge trend changes. A bullish crossover occurs when the MacD line rises above the signal line, which indicates a possible upward price movement.

The green histogram reinforces this signal and shows that the bullish impulse accelerates. The MacD approaches the zero line from below, which, when crossed, would further confirm a trend reversal on the top.

This MacD Breakout corresponds to the bullish signals that might be seen within the RSI and SMI indicators, and offers the case more weight for the continued price campaign.

Fartcoin occurs

The 4-hour diagram of Fartcoin to Tether (USDT) showed that the value rose back to the Ichimoku cloud and tested the early resistance from below.

Fartcoin/USDT – Ichimoku Cloud evaluation – 4h. Source: tradingview.com

Fartcoin/USDT – Ichimoku Cloud evaluation – 4h. Source: tradingview.com

The Ichimoku cloud, also often known as Ichimoku Kinko Hyo, is a comprehensive indicator that shows the trend direction, level of support and resistance and dynamics in a single view.

Fartcoin currently acts with USD 1.07,000, slightly below the exponential moving average of fifty period (EMA), now $ 1.10009. The lower border of the cloud is near $ 1.00150 and the upper limit is $ 1.09844. The price has entered this area and signals the beginning of a test against resistance.

The diagram also shows a current “weak bullish” signal that was printed below the present candle, followed by a “strong bear” signal from the start in June. While the cloud continues to be red, which indicates a continued bear structure, the value within the cloud and the approximation to the EMA information to a possible short-term reversal.

Backesting data within the table confirm the limited historical edge:

This indicates that the setup under the present strategy conditions historically only had limited reliability, however the outbreak of price and the dynamics ought to be observed in reference to volume and other signals.