Circle Internet Financial, the issuer of USD Coin (USDC), is preparing for the listing of the New York stock exchange under the Ticker CRCL. According to investor Chamath Palihapitiya, the corporate's IPO (IPO) has made demand that’s 25 -higher than the available stock offer.

Source: x

Circle to gather 1.05 billion USD $ 31 per share

Circle will sell 34 million shares of $ 31 each, above the previously marketed range of $ 28 to twenty-eight. The company evaluates this pricing with roughly 6.9 billion US dollars based on 220 million outstanding stocks. The company also gave the underwriters a 30-day choice to buy as much as 5.1 million additional shares.

Circle plans to make use of the proceeds to pay tax obligations, to develop recent products and to expand its business in accordance with the submissions of the US Securities and Exchange Commission (SEC).

This IPO is the third attempt by Circle to go public. Due to regulatory delays and market instability, a SPAC fusion of 2021 was canceled. In April 2025 it did one other IPO plan after US tariffs interrupted the worldwide markets.

Chamath Palihapitiya said that the acquisition of districts corresponding to Ripple or Coinbase may benefit from the corporate's position on the StableCoin market. He added that the shopping group may very well be low cost for a long-term horizon for $ 12 to $ 13 billion.

“If someone should purchase it for even 12 to 13 billion US dollars, it’s a bargain, IMO, for what this business may very well be value in 20 years,” he wrote.

Palihapitiya also mentioned that firms corresponding to Stripe, Block (formerly Square), Ripple and Coinbase could compete for leadership within the Stablecoin infrastructure. He explained that firms that supply efficient, inexpensive solutions could win the most important market share in the long term.

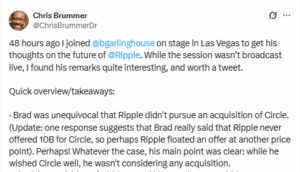

The alleged offers from Ripple for the district may require a better rating

Ripple Labs reported that Ripple Labs offered 5 billion US dollars to accumulate the circle, but Circle rejected the offer. Later, Ripple allegedly increased the offer to $ 9 billion and $ 11 billion. The CEO von Ripple refused to supply a ten billion dollar offer, but didn’t rule out the potential for discussions.

Source: x

Source: x

Circle has contested the input of acquisition talks with ripple or coin base.

Now that Circle's IPO is heavily oversubscribed, the corporate has won a stronger lever. It can resolve to proceed independently, unless future offers are a significantly higher assessment.

Transfer points for strong demand

Zero Hedge reported that the IPO of Circle is oversubscribed 25 times. This indicates that investors want way more shares than the corporate offers. With 34 million shares available, the demand exceeded 850 million shares definitely worth the value of.

Large investors have shown interest. ARK Invest, led by Cathie Wood, Plant, investing 150 million US dollars. Blackrock should buy a minimum of 10% of the corporate within the list.

Market analysts say that this demand is convinced that the IPO of Circle doesn’t completely reflect its share within the StableCoin sector.

From June 2025, Circle monitors 62 billion US dollars of USDC (USDC), with around 27% of the worldwide stable coin market.

In 2024, the corporate generated sales of 1.68 billion US dollars. The net result fell by around 42% in comparison with the previous 12 months and fell from USD 267.5 million in 2023 to $ 155.7 million. In its submissions, the corporate said that it intends to take a position its income again, and is just not planning to spend dividends presently.