On June 5, 2025, Pepe/Usdt formed a bullish-falling wedge pattern on the 4-hour table, which signaled a possible outbreak.

Pepe/usdt bulls take the lead, however the trend remains to be weak, DMI Showspepe/Usdt RSI meets over sales zone, impulse weakens weakens

Pepe/usdt Bullish Falling Wedge. Source: tradingview.com

A bullish falling wedge occurs when the value goes back between two convergent downward trends. It often indicates weakening sales pressure and a possible bullish reversal as soon as the value breaks over the upper line of resistance of the wedge.

At the time of education, Pepe acted at $ 0.0000001140. The projected breakout goal is on the confirmation of 0.0000002000 US dollars.

The price stays below the exponential moving average of fifty period (EMA), which acts as a dynamic resistance at $ 0.0000001237. The bullish setup would activate an important outbreak above the EMA and wedge resistance line.

The volume is removed throughout the wedge formation, which corresponds to the sample expectations. A volume backlog after Breakout would confirm the bullish reversal and support the goal.

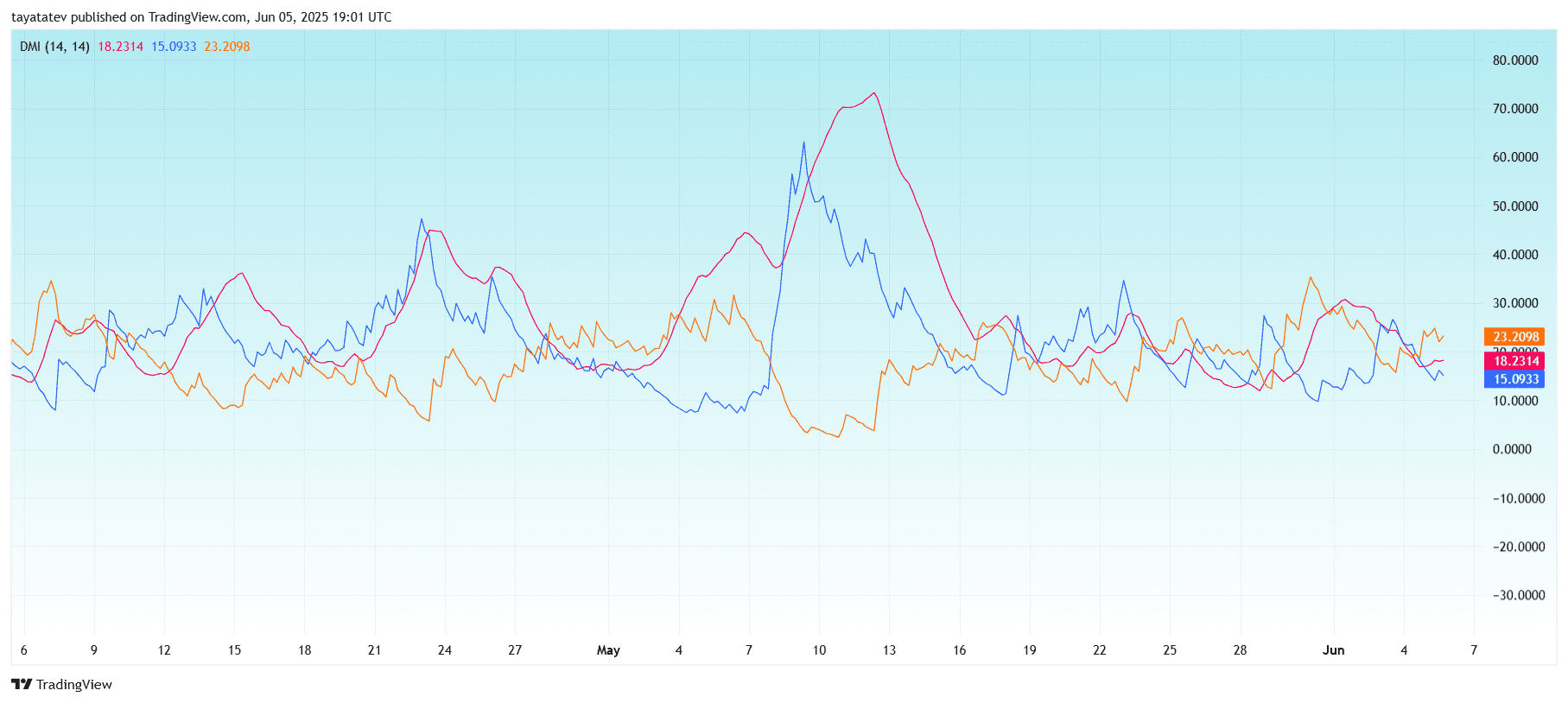

Pepe/usdt bulls take the lead, however the trend remains to be weak, dmi shows

On June 5, 2025, the directional movement index (DMI) showed signs of an early bullish impulse within the 4-hour PEPE/USDT diagram, but without strong confirmation. The positive directional indicator (+DI) was printed 23.20 and increases above the negative direction indicator (–di), which was 15.09. This positioning signals a slight advantage for buyers.

PEPE/USDT – direction movement index (DMI). Source: tradingview.com

PEPE/USDT – direction movement index (DMI). Source: tradingview.com

However, the common direction index (ADX) was 18.23 and remained well below the important thing 25 threshold, which defines a powerful trend. This indicates that the market stays in a weak or undecided state despite the optimistic positioning. In the last sessions, the +DI and –di moved closely and confirmed a low volatility and consolidation. This corresponds to the falling wedge pattern, which was previously discovered in the value card.

In order for the Bullish Breakout scenario to be activated, the ADX would should rise and grow growing dynamics. Until then, the direction of trend tends positively, but there’s a scarcity of strength for validation.

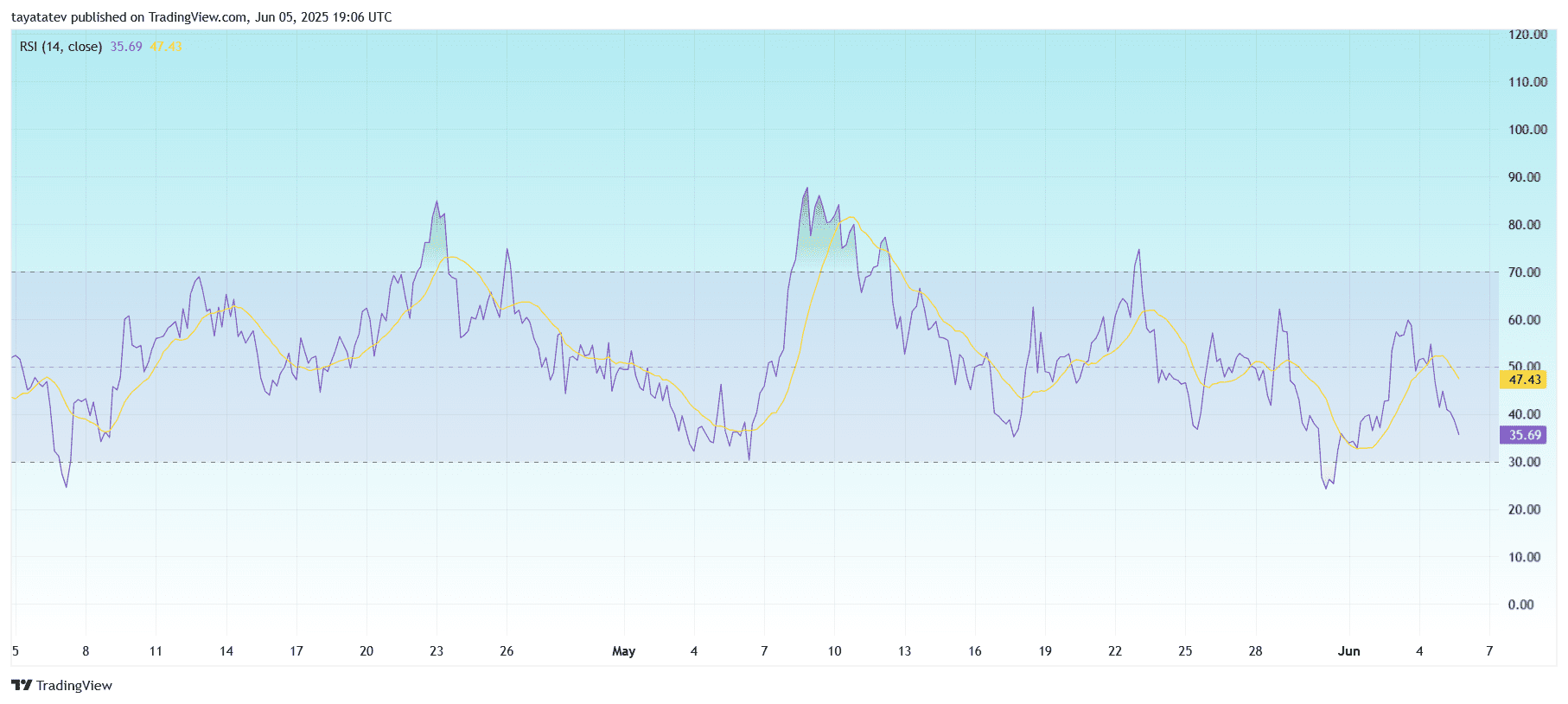

Pepe/Usdt RSI meets over sales zone, the dynamic weakens weakens

The 4-hour relative strength index (RSI) for PEPE/USDT sank to 35.69 and got here closer to the oversized threshold of 30. The sliding RSI average increases at 47.43 higher, which indicates the newest downward pressure.

Pepe/USDT – Relative strength index (RSI). Source: tradingview.com

Pepe/USDT – Relative strength index (RSI). Source: tradingview.com

The gap between the RSI and its average indicates that the short -term impulse becomes weaker. In the last sessions, Price tried to take care of upright movements, and the RSI has not managed to interrupt over the middle line (50), which signals a continued bearish mood.

While the RSI has not yet entered the oversold zone, its current level reflects a reduced interest in purchase and the increasing downfield. If it continues to fall under 30, this may trigger a response of buyers who’re on the lookout for a lower entry point.