On June 4, 2025, the Pair from Tron to United States created a rising channel pattern within the 4-hour table.

The TRX/USD directional movement index shows weak trend strength Strengthtrx/USD relative strength index approaches bullish zone

TRX/USD Ascending Channel Breakdown. Source: tradingview.com

An ascending channel appears when the worth between two parallel parallel trend lines moves and sometimes shows a gradual short -term upward trend.

If this pattern is confirmed with a breakdown below the lower red trend line, the worth of the present price of USD 0.27400 can fall to the projected goal of roughly $ 0.23568.

TRX/USD is currently dealing near the upper half of the channel. The exponential sliding 50-period average (EMA), which is now $ 0.27095, acts as dynamic support. The price campaign stays barely above the EMA, however the youngest candles show a falling dynamic.

In addition, the quantity has remained low despite the small upward movements. This indicates that buyer strength becomes weaker. If the worth doesn’t have the lower trendline support, sellers can take control and initiate breakdown towards the zone of 0.23568 USD, which is marked by the blue dotted line.

The structure stays valid until either breakdown or the worth breaks above the border of the upper channel.

TRX/USD directional movement index shows a weak trend strength

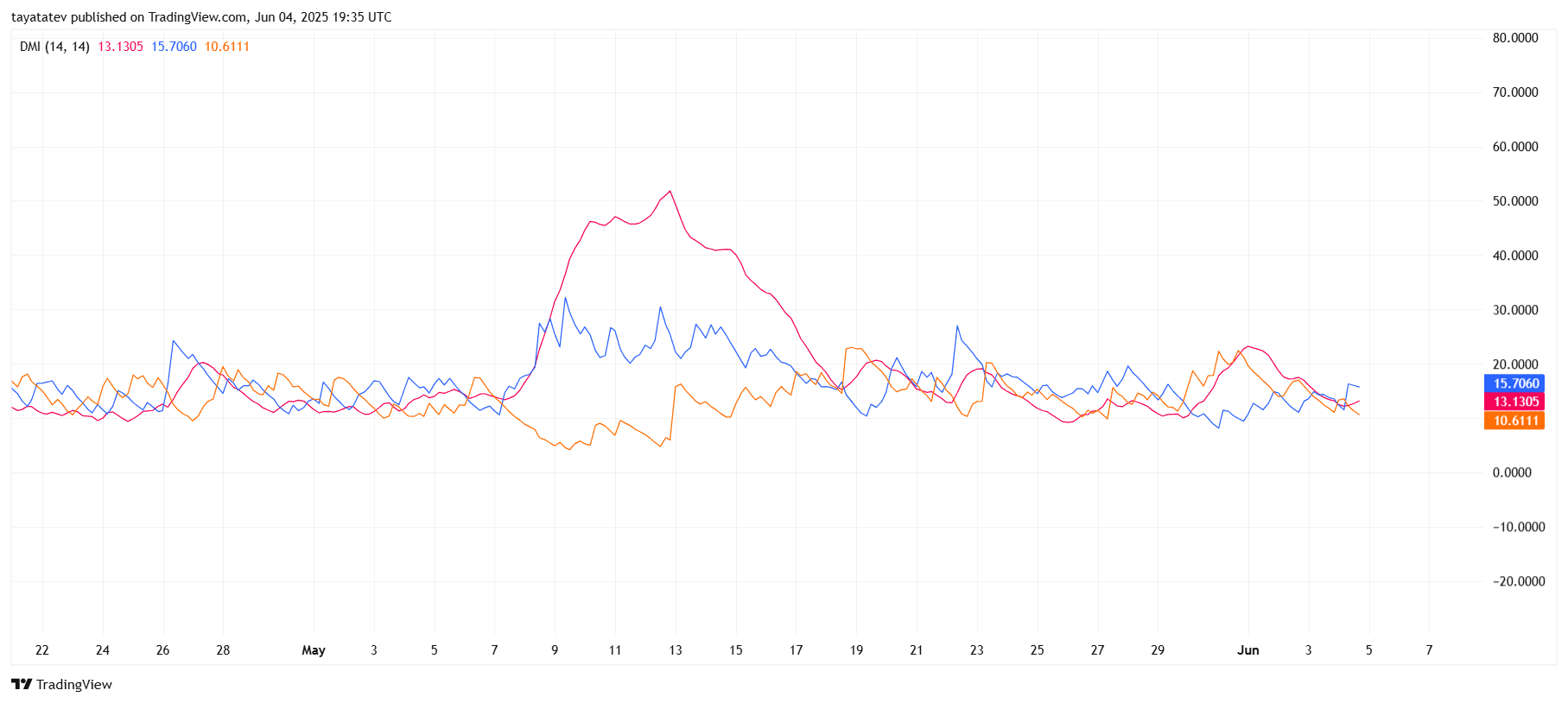

On June 4, 2025, the indicator of directional movement index (DMI) showed a weak trend dynamics for Tron to United States Dollar (TRX/USD). The DMI relies on three lines: the positive directional display (+DI, blue), the negative direction indicator (−di, red) and the typical direction index (ADX, orange).

TRX/USD Directional Movement Index (DMI). Source: tradingview.com

TRX/USD Directional Movement Index (DMI). Source: tradingview.com

From the most recent data:

-

+From (blue) = 15.71

-

−di (red) = 13.13

-

Adx (orange) = 10.61

An ADX value below 20 signals a weak or non-trendy market. The ADX is currently 10.61 and confirms the strength of the low trend strength.

The +DI stays barely over −di, which indicates marginal bullish control. However, the low gap between them together with the low ADX signals the indecisiveness and the low conviction of each buyers and sellers.

Previously, the ADX rose in mid -May when the worth moved up sharply. Since then, the indicator has decreased steadily and shows that the momentum has faded over time.

If the ADX rises again, while +Di stays above −di, this could form on a brand new bullish trend. However, if −di crosses via +DI with an increasing ADX, the Bärische pressure could increase. TRX/USD currently stays in a consolidation phase with low volatility.

Trx/USD relative strength index approaches bullish zone

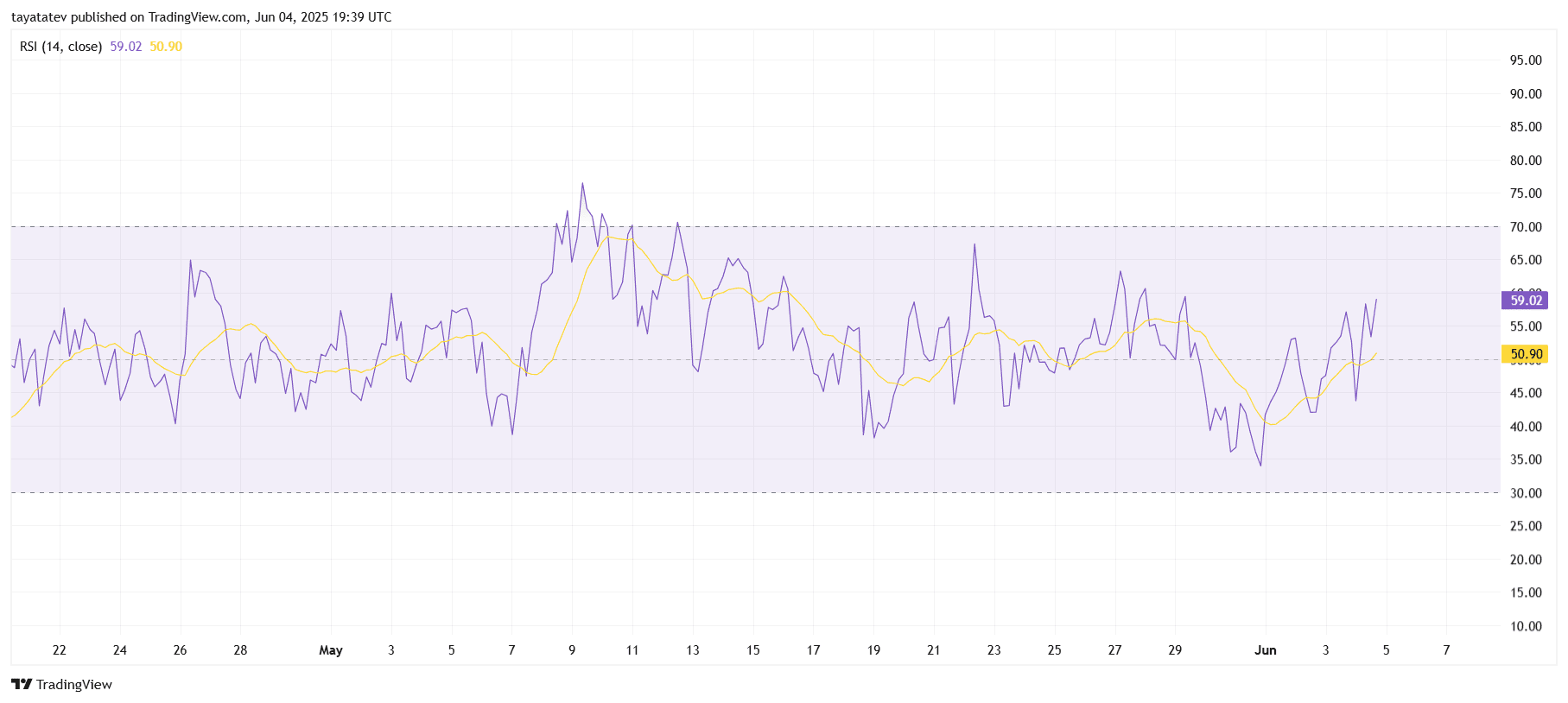

On June 4, 2025, the relative strength index (RSI) for Tron to United States Dollar (TRX/USD) was on the 4-hour diagram at 59.02.

TRX/USD relative strength index (RSI). Source: tradingview.com

TRX/USD relative strength index (RSI). Source: tradingview.com

The RSI is an impulse indicator that measures the speed and alter of price movements. It swings between 0 and 100:

-

Values over 70 indicate overbought conditions.

-

Values under 30 suggest oversold conditions.

-

A level near 50 shows a neutral impulse.

At the moment, the RSI stays below the overbought threshold, but trends upwards. This signals that bullish dynamics increase.

The yellow line (sliding average of RSI) is 50.90, and the RSI line has crossed it. This crossover often confirms the strengthening of the upward pressure.

In addition, RSI has consistently achieved higher lows since June. This structure supports potential bullish sequel if the worth will not be implemented.

If RSI presses and applies over 60, this could signal a stronger bullish phase. However, the failure to interrupt this zone can keep TRX/USD in rank -bound movement.