The PI Network mobile app is checked across rising data protection and security concerns. While some users report that they’ve triggered their PI coins for goods and services in the true world, others warn of the app's data acquisition practices and the dearth of regulatory supervision.

The app requires access to contacts and private identification via your customers (KYC) processes. Critics argue if this data is leaked or abused, users might be exposed to phishing attacks or identity theft. A Reddit user commented and said:

“When the PI user list is leaked, it’s a gold mine for crypto-targeted fraud.”

Despite these warnings, several users claim to have exchanged PI coins for smartphones, payments or services in parts of Asia and Floridas, which indicates a limited use in the true world. However, the coin is just not available in large exchange and its value stays highly speculative.

The app currently doesn’t constitute a direct financial risk because users don’t make any money. However, data protection experts recommend restricting the permissions and removing the app if users not wish to participate.

PI network price forms fall wedge, which is offered to an upward potential of 98%

On June 2, 2025, the 4-hour diagram of PI network (PI/USDT) on OKX formed a falling wedge pattern. A falling wedge is a bullish reconstruction, by which the worth between two convergent trend lines moves downwards converging downwards and infrequently signals weakening pressure of the sale before an outbreak.

PI network -falling wedge pattern. Source: tradingview.com

The current price is 0.6398 USD and is below the 50-pro-period exponential average (EMA), which is $ 0.6963. The volume stays relatively low at 5.54 million and shows a reduced market activity when the wedge narrowed.

If the pattern confirms with an outbreak above the upper red trend line, the worth of its current level can goal 98% to the $ 1.2792 mark. This goal is predicated on the peak of the previous peak of the wedge.

The most up-to-date price campaign shows compression near the lower border of the wedge, with repeated suggestions indicate a possible accumulation with the next volume. However, the token has to recapture the 50 EMA to validate the optimistic dynamics.

If buyers exceed the resistance, the move PIS can reflect earlier vertical rally in mid -May when the worth rose before a pointy correction. The price is currently within the wedge and is waiting for confirmation.

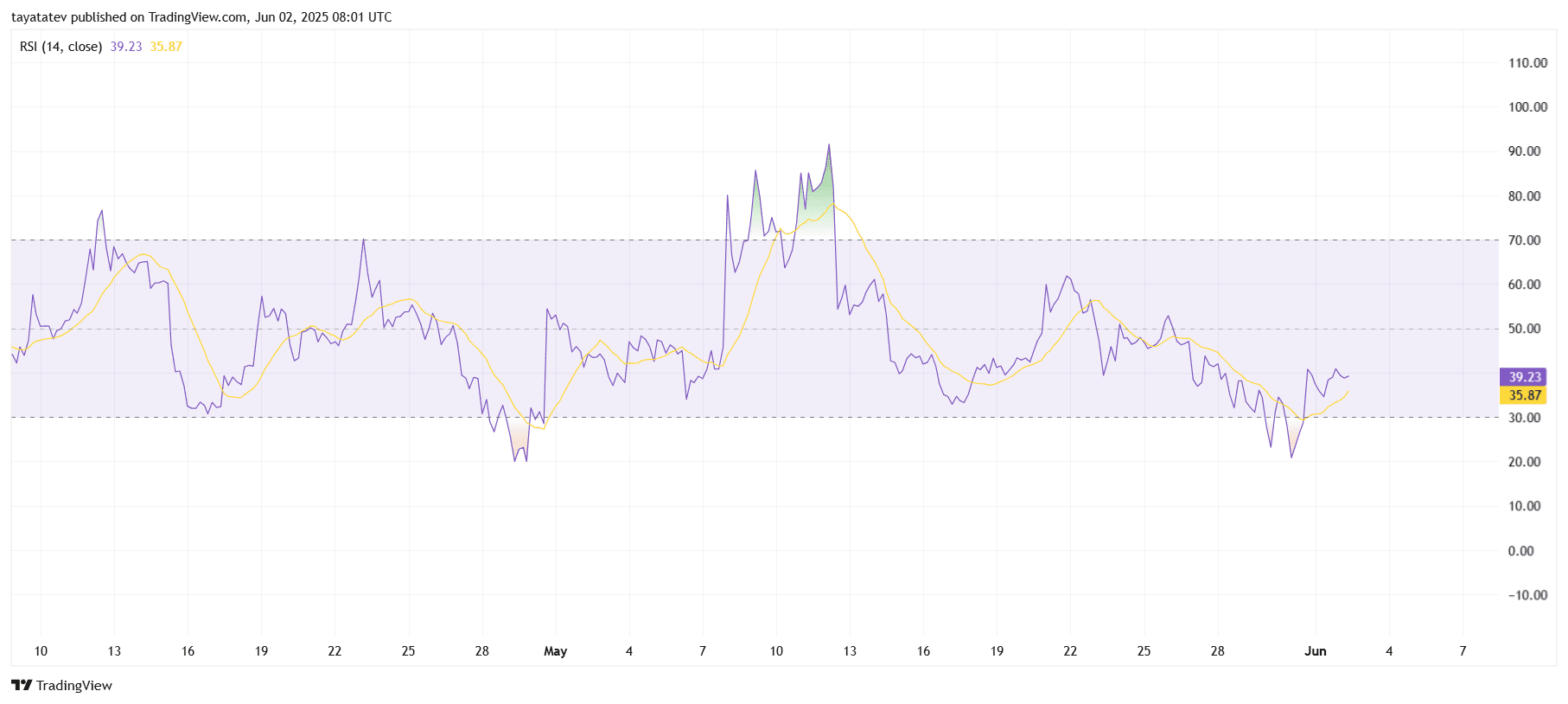

The PI network RSI shows a weak impulse with an early reversal sign

On June 2, 2025, the relative strength index (RSI) for PI Network (PI/USDT) was 39.23 within the 4-hour table, while the sliding average line printed 35.87. This shows that the token leaves the oversized region, but still acts under the neutral 50 line.

PI -Netzwerk -rsi trend evaluation. Source: tradingview.com

PI -Netzwerk -rsi trend evaluation. Source: tradingview.com

The RSI (14) or 14-period relative strength index measures the newest price strength on a scale from 0 to 100. Values under 30 indicate oversold conditions, while measured values over 70 indicate that the asset could be overdone.

After he was almost 30 years old at the top of May, the RSI began climbing. This signals that the bear pressure slows down and indicate a possible recovery. The youngest cross of the indicator above its sliding average adds a possible reversal of short -term trends.

However, the RSI values remain below the 50 threshold. Until the index recaptures this center, the Bullische Smindings remain limited. Dealers pays close attention to a clean break over 50, which may confirm the brand new dynamic.

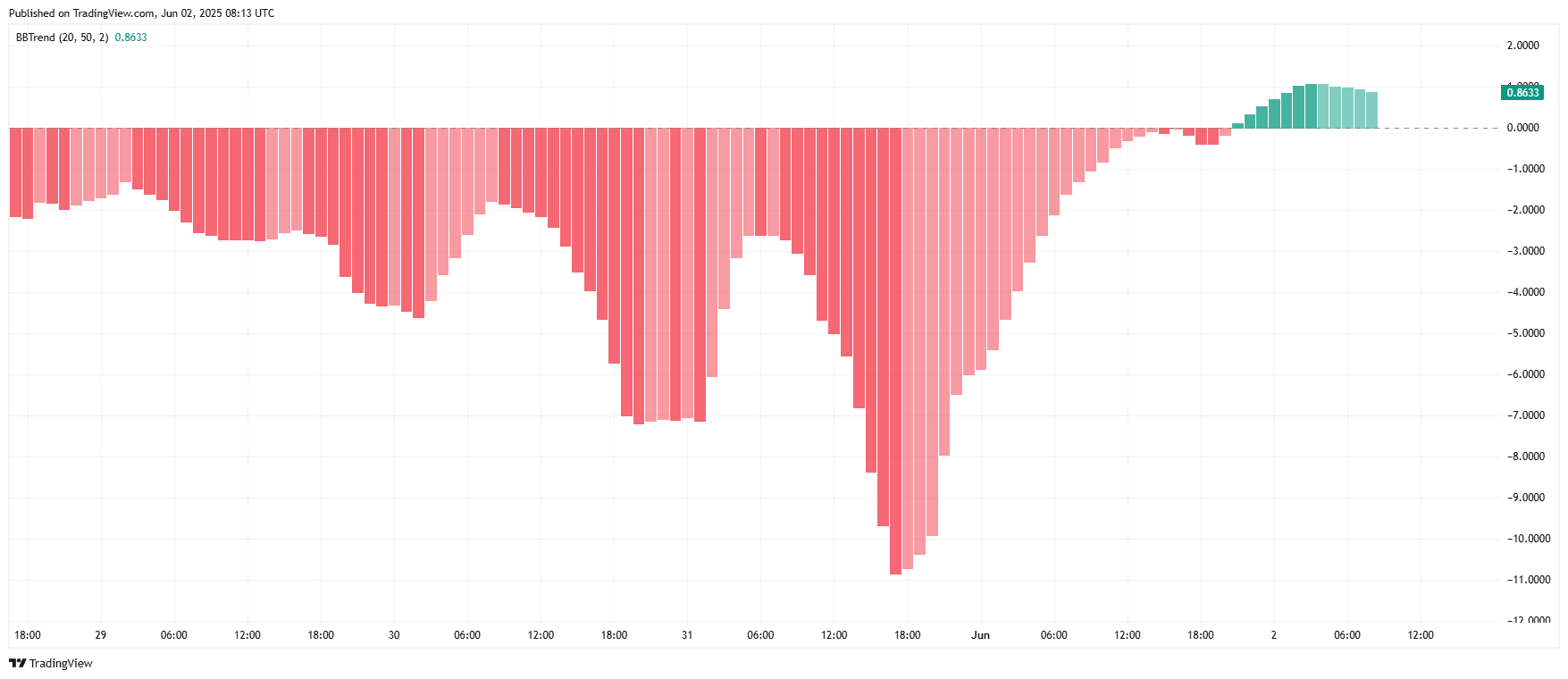

PI network BBTREND freakes after a protracted downward trend positive

In the meantime, the BBTtrend (Bollinger Band Trend) indicator of PI Network (PI/USDT) was positive and printed a price of 0.8633. This marks the primary shift to the bullish territory after an extended period with strong downside dynamics.

PI network BBTREND Directional Shift. Source: tradingview.com

PI network BBTREND Directional Shift. Source: tradingview.com

The BBTREND indicator, which mixes elements of Bollinger tapes with trend tracking, helps to discover guideline. Negative values Signal bear pressure, while positive values indicate an emerging upward trend.

From May 29 to June 1, BBTREND remained deeply negative and fell below below -11.0Reflecting sustainable sale and volatility compression. However, a continuing transition from red to green bars shows gradual fading of the bear's strength and a shift for potential price recovery.

This step corresponds to other bullish signals, including a falling wedge eruption and early RSI recreation. If BBTREND continues to extend, this could confirm the reinforcement of the upward pynamics within the upcoming meetings.

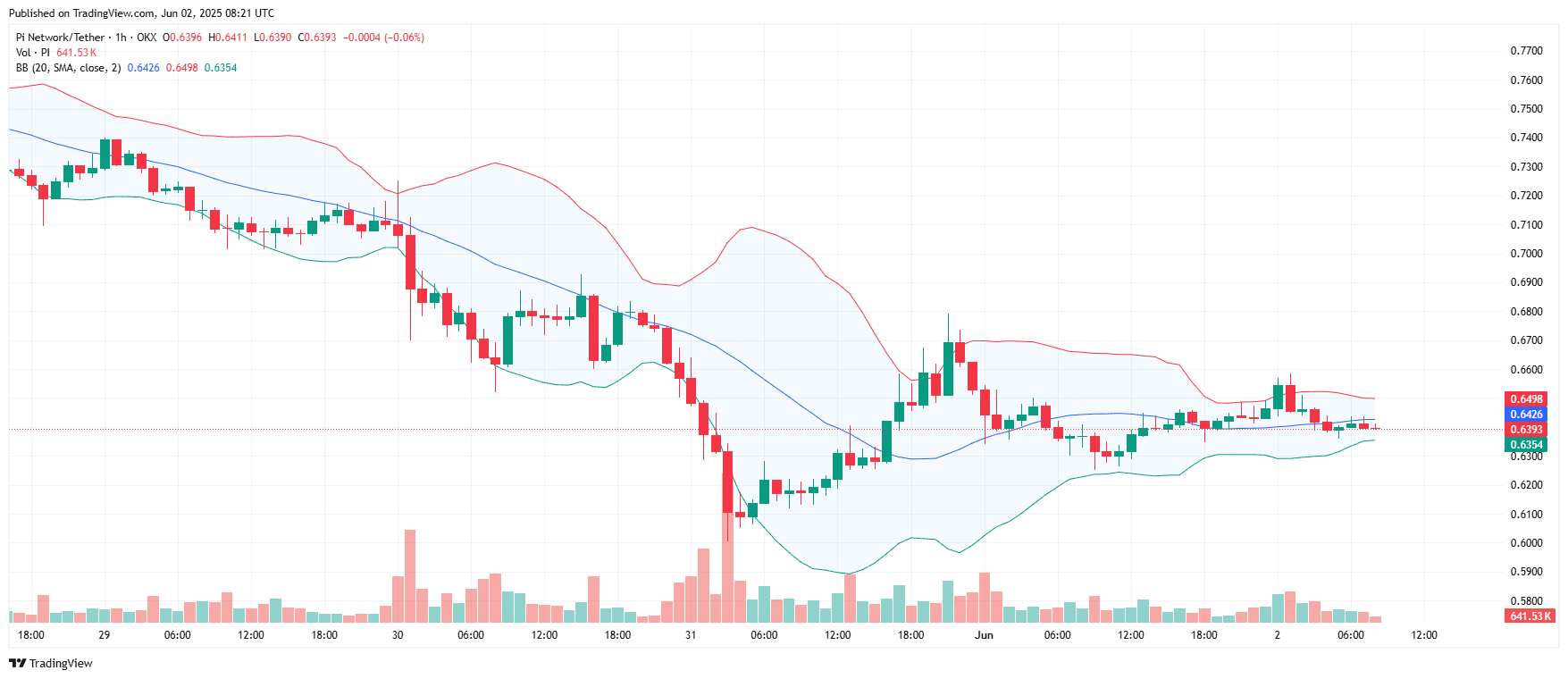

PI network acts flat in narrow Bollinger ligaments with low volume

On June 2, 2025, PI Network (PI/USDT) consolidated with the worth with a pinch of near $ 0.6393 sideways. The Bollinger-Lacelig-based on a straightforward 20-year-old sliding average configure a detailed narrowing between the upper band at $ 0.6498 and the lower volume at $ 0.6354.

PI network Bollinger -Bands Squeeze.source: tradingview.com

PI network Bollinger -Bands Squeeze.source: tradingview.com

Bollinger tapes pursue volatility by representing standard deviations by a sliding average. Team tapes normally precede a pointy outbreak in each directions.

Currently, the worth is just under the center band ($ 0.6426), which indicates neutral to light -braiding dynamics. The volume stays low at 641.53 K, which reduced the participation.

The price rose briefly over the upper gang through the rally on June 1, but quickly. Since then, the worth campaign near the middle line has shifted with out a strong directional strain. A vital step outside the ligaments could trigger a brand new volatility.

PI network acts flat in narrow Bollinger ligaments with low volume

On June 2, 2025, PI Network (PI/USDT) consolidated with the worth with a pinch of near $ 0.6393 sideways. The Bollinger-Lacelig-based on a straightforward 20-year-old sliding average configure a detailed narrowing between the upper band at $ 0.6498 and the lower volume at $ 0.6354.

PI Network Bollinger -Bands Press ․ Source: tradingview.com

PI Network Bollinger -Bands Press ․ Source: tradingview.com

Bollinger tapes pursue volatility by representing standard deviations by a sliding average. Team tapes normally precede a pointy outbreak in each directions.

Currently, the worth is just under the center band ($ 0.6426), which indicates neutral to light -braiding dynamics. The volume stays low at 641.53 K, which reduced the participation.

The price rose briefly over the upper gang through the rally on June 1, but quickly. Since then, the worth campaign near the middle line has shifted with out a strong directional strain. A vital step outside the ligaments could trigger a brand new volatility.