On May 31, 2025, the 4-hour diagram of Tron to Us Dollar (TRX/USD) created a bear-rising wedge pattern.

Trx RSI shows the bear impulse under the important thing threshold value MACD Histogram, trx loses a bullish impulse

TRX/USD 4-hour diagram. Source: tradingview.com

A bear -like wedge forms when the value moves inside two upward flows and trend lines converge and typically signals a possible trend reversal and abortion.

The TRX/USD diagram has shown the value consolidation between the red trend lines for the reason that starting of May. On May thirtieth, Trx broke below the lower border of the wedge and dived under the 50-period exponential moving Average (EMA), which is currently $ 0.2727.

At the time of the outbreak, Trx acted near USD 0.2693. If the wedge confirms, the value can fall from the present level by about 12%. This movement would place Trx near the zone of 0.2356 US dollars, which is tailored to the table by the horizontal blue dotted line.

The volume through the collapse showed a slight increase, which indicates that the sales pressure was increasing sales pressure. The pattern is invalid when TRX recaptured the EMA of fifty periods and closes back within the wedge structure.

If the momentum goes down, 0.2356 US dollars could act as the following key support zone.

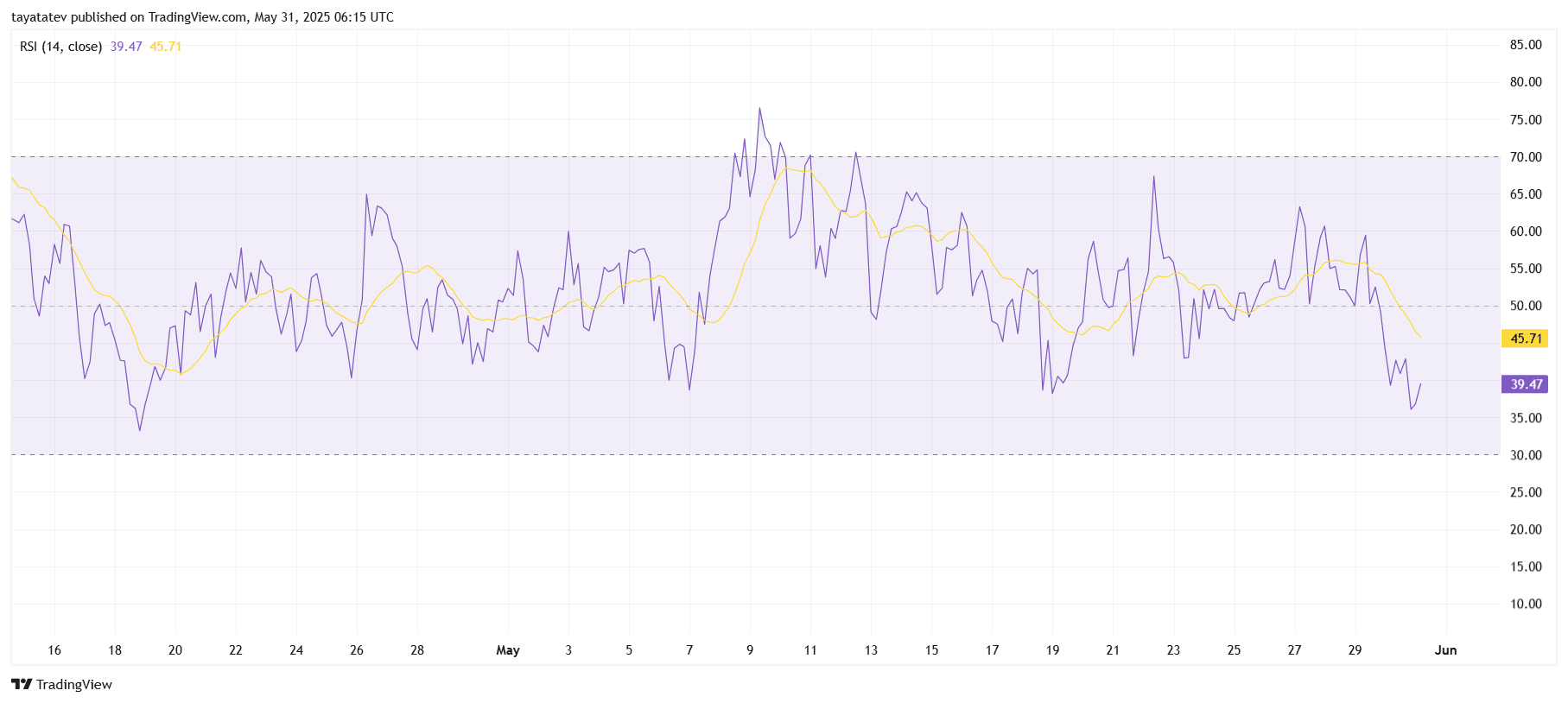

Trx RSI shows the bear impulse under the important thing threshold

The 4-hour relative strength index (RSI) for Tron (TRX/USD), published on May 31, 2025, is 39.47, while the sliding average of 14 periods is 45.71 in accordance with the TradingView.

TRX/USD 4-hour RSI diagram. Source: tradingview.com

TRX/USD 4-hour RSI diagram. Source: tradingview.com

The RSI, which pursues the strength and speed of the value movements, has remained below the neutral 50 level. This confirms the bearish swing. After the immersion near 35, the RSI jumped barely, however the recovery was lacking. The indicator stays good on average and shows no signs of an instantaneous reversal.

The RSI line, which remained below the sliding average signals, stood down. If the RSI doesn’t break over 50 and exceeds its average from below, it’s unlikely that TRX will go upwards. This indicator supports the bear's Bärische breakthrough observed in the value card and, with a possible continuation, is within the direction of lower support levels.

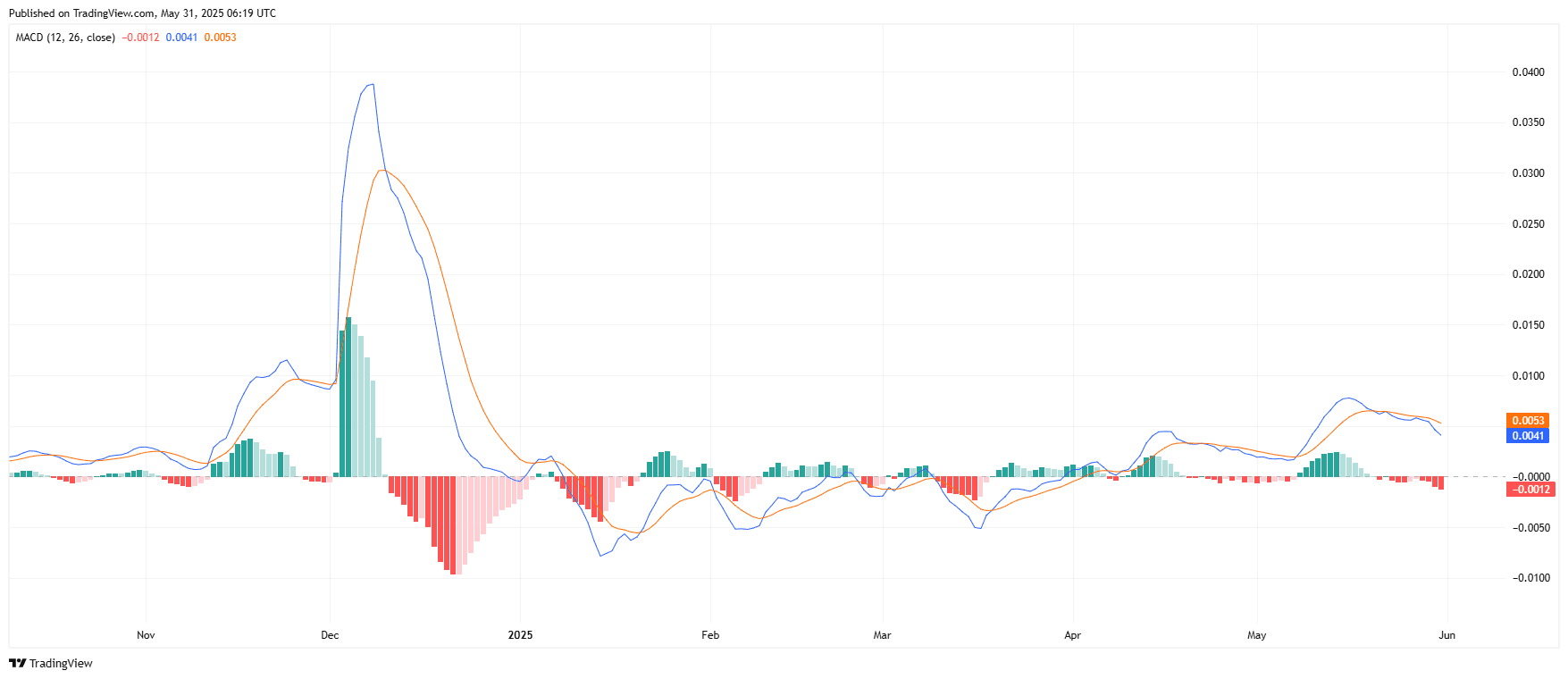

MacD histogram becomes negative, TRX loses a bullish impulse

The MacD diagram for Tron (TRX/USDT) published on May 31, 2025, which was published on May 31, 2025, shows a weak dynamic. The MacD line (blue) is 0.0041, the signal line (orange) at 0.0053 and the histogram is –0.0012.

TRX/USDT MACD diagram. Source: tradingview.com

TRX/USDT MACD diagram. Source: tradingview.com

The MACD is an impulse soscillator that pursues the connection between two movable average values. A Bärisches Signal occurs when the MACD line exceeds below the signal line, which frequently indicates the reversal or lack of strength.

In this case, the histogram has grow to be negative and confirms a bearish crossover. The MacD line now falls under the signal line, which indicates that Trx has lost its recent bullish dynamics. The histogram beams have also dropped below zero, which increased the shift to sell the pressure.

Unless a bullish crossover appears again, the MacD setup matches the weakness shown on the RSI and price diagrams.