BNB price campaigns show signs of pressure and potential, while the binance's binance is robust. Let us examine what happens within the charts and in court.

BNB goals at 16% Rally if the worth lasts over crucial triangular support

On May 30, 2025, the 4-hour Binance coin formed a rising triangle pattern for Tether (BNB/USDT).

BNB/USDT 4-hour diagram. Source: tradingview.com

An ascending triangle is a bullish sequel that appears when the worth makes higher depths and at the identical time fulfills the resistance at a flat horizontal level and corresponds to potential outbreaks from the outbreak of the potential.

If the pattern confirms, the worth can increase by 16% from the present level of $ 671.55 to roughly $ 778.42.

The price is currently testing the lower support trend line of the triangle. It has already dropped under the 50-pro-exponential moving average (EMA), which is $ 674.25. This violates that short -term dynamics weaken. However, the structure of the triangle stays intact in the interim.

The volume stays relatively low on this test phase. This is typical of huge outbreaks or outbreaks. If BNB tears off from this support line and interrupts over the horizontal resistance near 700 US dollars, this might activate the 16% management.

However, if the worth breaks under the rising support trend line with increasing volume, the bullish setup would invalidate. After an important candle and confirmation, retailers will probably listen to the resistance to validate the goal of the pattern.

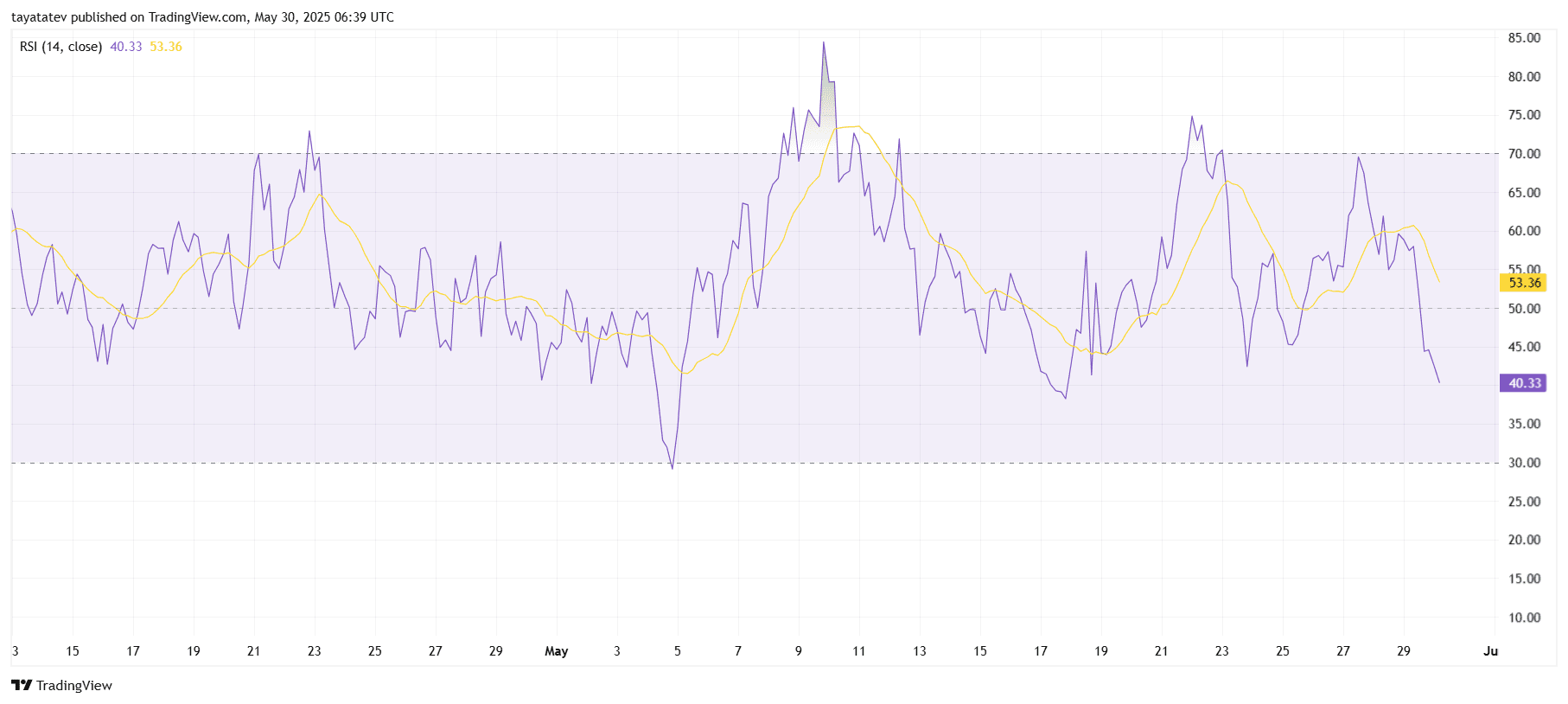

BNB RSI falls within the direction of oversized zone and signals a weak impulse

On May 30, 2025, the 4-hour Binance coin for Tether (BNB/USDT) showed the 14-period relative strength index (RSI) and the moving average.

BNB/USDT 4-hour RSI diagram. Source: tradingview.com

BNB/USDT 4-hour RSI diagram. Source: tradingview.com

The relative strength index is an impulse soscillator that measures the speed and alter of price movements on a scale of 0 to 100. Measurement values below 30 interpret overly sold conditions, while the measured values display over 70 over -operated levels.

At the time of the evaluation, the RSI is 40.33, while its sliding average is 53.36. This positioning shows that the dynamics of the oversized zone flows and approaches. The sharp drop of over 60 to the present of 40 range increases at short notice.

In addition, the RSI line crossed under its sliding average and confirmed the downward dynamics. This crossover often indicates that short -term sales pressure stays, unless the RSI moves and crosses again.

If RSI continues to fall at 30, this will indicate stronger sales dynamics. However, if it stabilizes or reverses from the present levels, this will indicate early accumulation or the prerequisite for sideways.

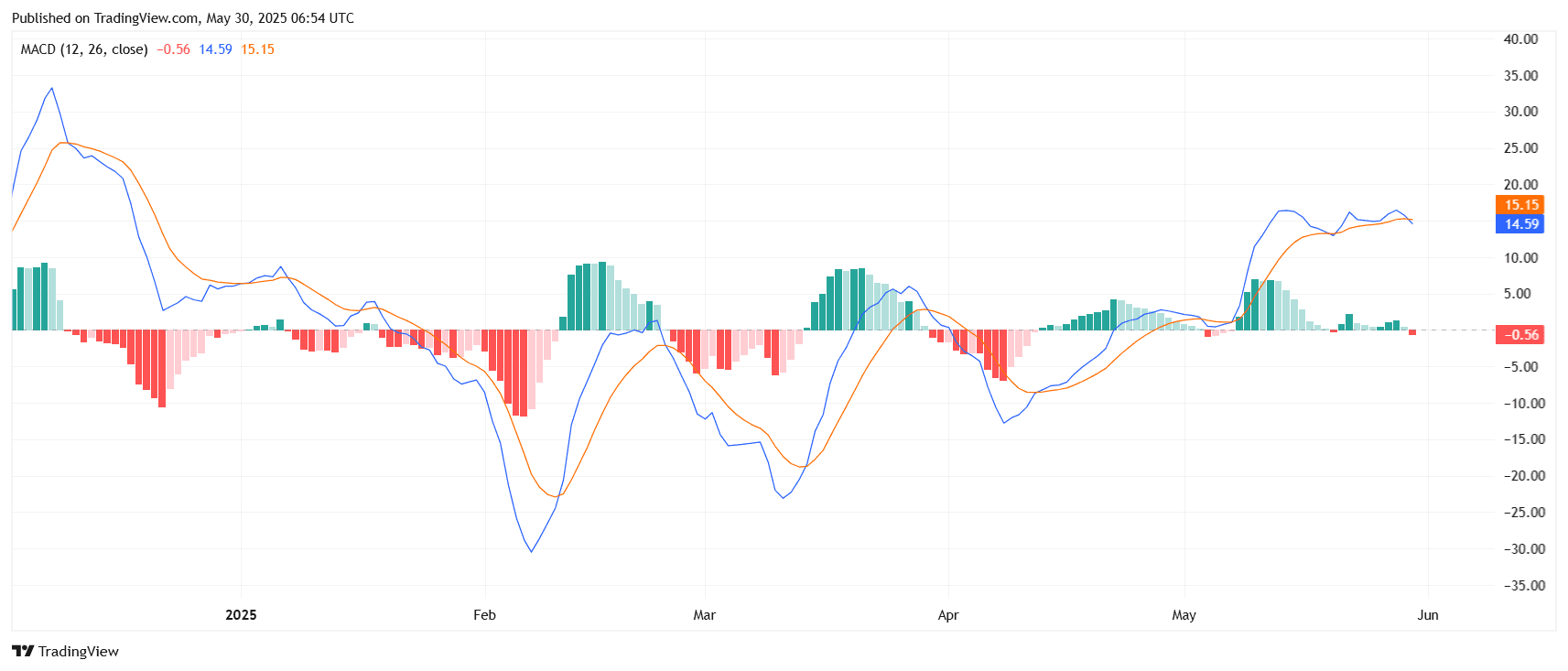

BNB MACD Bearish Crossover signals the lack of dynamic

On May 30, 2025, the day by day Binance coin for Tether (BNB/USDT) showed a weak signal for the indicator of the sliding average convergence (MACD).

BNB/Usdt Daily MacD diagram. Source: tradingview.com

BNB/Usdt Daily MacD diagram. Source: tradingview.com

The moving average convergence divergence is a classy impulse indicator that shows the connection between two moving average values of the worth of security. It consists of the MacD line (blue), the signal line (orange) and the histogram.

At the time of the evaluation, the MACD line is 14.59, while the signal line is barely higher at 15.15. The histogram shows a negative value of -0.56, which points out that the MACD line is crossed under the signal line.

This crossover indicates a possible bear shift of the impulse. The histogram has just grow to be red and confirms the early sales pressure. If this trend continues, it will probably suggest an extra drawback or further consolidation at short notice.

However, the separation between the lines stays tight, and a reversal remains to be possible if the MACD line exceeds at the highest. Dealers typically observe after a deeper histogram contraction or widening to validate the direction of impulse.

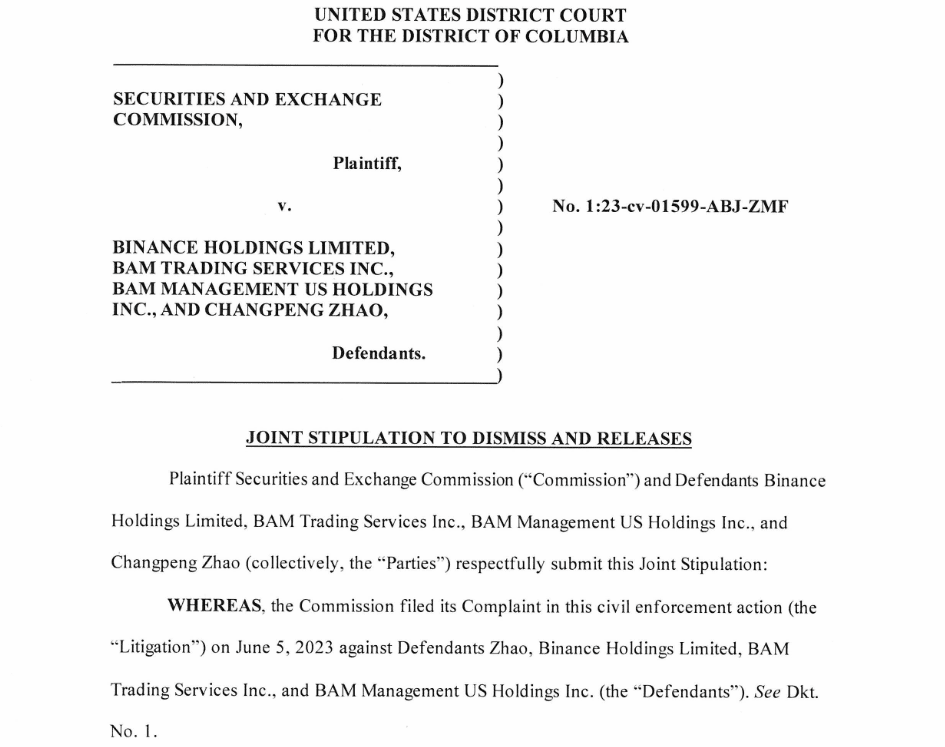

SEC finished Binance grievance in great change under Trump Administration

On May 29, 2025, the US Securities and Exchange Commission (SEC) ended their almost two -year lawsuit against Crypto Exchange Binance and his co -founder Changpeng Zhao. The SEC and Binance submitted a joint application in a federal court in Washington, DC, which applied for the case with prejudices and blocked the longer term recent settings.

Sec v. Binance Joint Stubulation for discharge and publication. Source: District Court of the United States for the district of Columbia

Sec v. Binance Joint Stubulation for discharge and publication. Source: District Court of the United States for the district of Columbia

In the submission it was found that the interior crypto -act force of the SEC “could influence and facilitate the potential solution of this legal dispute”. The agency quoted political considerations and discretionary assessments as reasons for dismissal.

The lawsuit began in June 2023, when the SEC Binance, ZHAO, and its US argument trading accused against securities laws, abuse of customer funds and misleading users. However, the court proceedings stalled in February and again in April 2025, which indicates that the agency checked its position.

This application was made only a number of months after Binance and Zhao solved a separate case with the Ministry of Justice of the US Justice Ministry in November 2023. This agreement included a penalty of $ 4.3 billion, the approval of violations of sanctions, no licensed transmission of cash and weak anti-money laundering controls. Zhao returned as CEO and later received a 4 -month prison sentence in April 2024 after he was guilty of cash laundering.

After the withdrawal of the SEC, Binance replied to X and described the move as a “great victory for crypto” and, President Donald Trump and the brand new SEC chairman Paul Atkins, to reverse the assertive attitude of the agency.

The release marks an extra withdrawal of the SEC under the Trump administration. The regulatory authority recently stored or defined cases against coinbase, consensys and octopuses. It also concluded the investigations on the circle, more unchanged and OpenSea.

The chairman Atkins, a former crypto lobbyist, has undertaken to exchange the enforcement of regulation through political discussions. Under his leadership, the SEC has introduced industry round tables to design a proper digital asset framework.