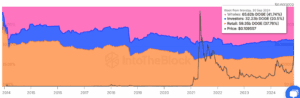

The each day lively addresses of Dogecoin (Doge) on May 28 to 57,500, a rise of 94% in comparison with the predecessor and the best level because the starting of March.

Waltransactions drop when the worth of retail and intermediate level approaches the accumulus course price

In May the network of Dogecoin showed subdued activity, with each day lively addresses between 25,000 and 30,000. This sharp climb was almost twice as high because the baseline of the month and stood up as a transparent anomaly.

Dogecoin day-after-day lively addresses. Source: Santiment

A possible catalyst might be the updated preliminary prospectus for the 21 -shares Dogecoin ETF, which was submitted on the identical day. It just isn’t a brand new application itself, however the Bloomberg ETF analyst Eric Balchunas makes it clear that it’s a change in an earlier submission.

He found that such changes often follow internal reviews or regulatory feedback.

21Shares submitted a modified registration for the Dotecoin ETF. Source: x

21Shares submitted a modified registration for the Dotecoin ETF. Source: x

Waltransactions decrease when retail and medium -sized carriers collect

Despite increasing address activity, Dogecoin's whale transactions are damped.

On May twenty eighth, Doge recorded only $ 43 transactions over $ 100,000 and $ 5 over $ 1 million, which has shown a continued removal time in high-quality transfers since March. In addition, Dogecoin whales last 41.74%of the Doge offer, while medium-sized investors make 20.5%and retail owners 37.76%.

Doge whales control only 41% of the offer. Source: Intotheblock

Doge whales control only 41% of the offer. Source: Intotheblock

The relatively balanced distribution shows that Dogecoin just isn’t overly concentrated under whales and that the retail and middle level money exchanges out there appearance plays a more lively role. This is in contrast to other memores, which are sometimes based on a small variety of addresses for many liquidity.

Santime data also show a continued accumulation by container pockets that observe 1 to 10 m of dog with a slight increase at 10 m to 100 m of dogen. The total variety of Doge's owner has increased to 7.54 million up to now two weeks, which increases a rise in growing long -term participation.

Doge Price Gannen Apex from Daigrängle

The 4-hour table is currently around 0.224 USD, that are blocked in a descending triangle pattern. This structure has a flat support level of $ 0.215 and a descending resistance trend line, which begins near USD 0.26 and is now pressing near $ 0.23.

Doge 4-hour price diagram. Source: Tradingview

Doge 4-hour price diagram. Source: Tradingview

The relative strength index (RSI) is neutral at 49.3, which indicates an absence of impulse in each directions. The volume has remained relatively low and further increases because the present price zone reflects the indecisiveness.

An outbreak above the resistance level of 0.23 US dollars could stimulate DOGE within the direction of the range of 0.25 to 0.27 US dollars, which marks the following supply zone based on previous price cuts in early May. An failure to interrupt the resistance could trigger a decline in comparison with $ 0.20, especially if the support of $ 0.215 breaks.