On May 28, 2025, the 1-hour diagram of near/Usdt produced a bearish flag pattern on Binance.

Prerequisite for the bear flag. Source: tradingview.com

A bearish flag pattern forms when the worth drops heavily after which consolidates upwards inside two parallel lines before they’re continued down.

If this pattern confirms, almost 11% of the present price of $ 2.822 could drop to the projected goal of USD 2.509.

The diagram shows a steep decline that formed the flag mast, followed by sloping from a channel. This channel signals temporary leisure, but often leads to a different leg. The price is now under the 50-period exponential sliding average (EMA), which is $ 2.830 and acts as a dynamic resistance.

The breakdown would confirm if near the lower trend line of the red channel closes with the next volume. The volume is currently moderated at 546,250, but every spike on a red candle would confirm the move.

If that is confirmed, this setup will proceed to diminish to scale back the support area of 2.509 US dollars, which is characterised by the blue horizontal line. This goal reflects the complete height of the flag mast, which is projected down from the breaking point.

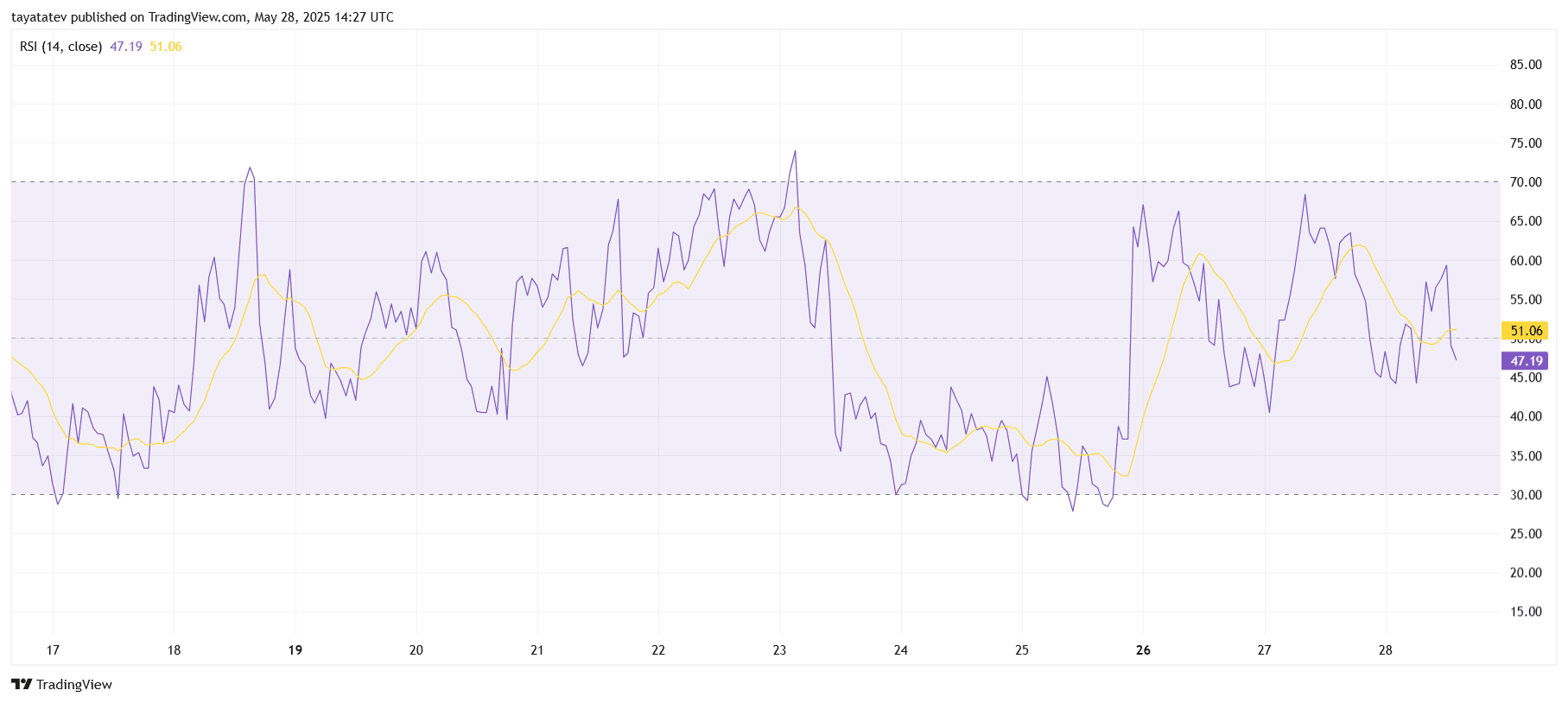

Near RSI sinks under signal line, weak impulse is build up

On May 28, 2025, the 1-hour diagram for relative strength index (RSI) showed a reading of 47.19. The RSI recently exceeded 14 periods below the sliding average line, which is 51.06.

Nah/USdt RSI -Impulse diagram. Source: tradingview.com

Nah/USdt RSI -Impulse diagram. Source: tradingview.com

The relative strength index measures the worth impulse on a scale from 0 to 100. A worth under 50 shows a weak Dullish printing, while a decline below 30 signals oversized conditions.

Currently near shops below the neutral 50 brand, which show that sellers have taken control. The crossover of the RSI below the sliding average confirms a bearish signal. It adds weight to the previous flag creation observed in the worth card.

If the RSI moves to the side and under the common line, the impulse stays weak. If the RSI doesn’t bounce off with strength over 50, the downward pressure could be continued at short notice.

He rolls near global contracts with Nearcore 2.6 upgrade

On May 28, 2025, the co -founder of Protocol Illia Polosukhin near the protocol announced the introduction of Nearcore 2.6, through which global contracts were introduced.

Polosukhin explained that intelligent accounts need sufficient compensation before upgrading to cover the storage costs. This requirement forced the developers to make use of the identical contract several times across different shards. The Nearcore 2.6 update eliminates this friction by operating contracts with a single provision across all shards. As a result, developers now avoid duplication, reduce operational complexity and save time.

Global contracts offer considerable costs. Early tests that were shared by the Community member @Slimedrgn showed that the supply of smart wallets for a million users nearby only costs 59 and 20 near updates.

Apart from the fee efficiency, Nearcore 2.6 also shortens the block time from 1 second to around 600 milliseconds. This upgrade accelerates the transactions and improves response, which supports more advanced use cases in real -time applications.

Modular ecosystem profits and protracted challenges

The upgrade solves Shard Communication Problems through the introduction of universal contractual identifiers. Each account can now be linked to a standard contract by any shard without having manual inter-shadnations. Developers can create standardized modules, just like importing libraries. These contracts remain unchangeable after the supply and make sure the logical consistency and fewer integration problems for decentralized applications.

This common structure supports faster onboarding, modular development and long -term ecosystem stability. However, the challenges of the federal government remain. It remains to be unclear who should manage and update the contracts used together. Some community members propose to approve almost native decentralized autonomous organizations (DAOS) to approved upgrades.

Security stays in the main target. Since many apps can rely upon a single contract, any error could have far -reaching effects. Developers need a proper review and regular audits to stop weaknesses. Since the contracts are unchangeable, teams must depend on proxy patterns or modular upgrades with a purpose to advance future improvements.

With this step, near a wider shift within the industry, connects towards accessibility and reduced friction. Polosukhin emphasized that the design of the network now, including tools, prioritizes each for developers and for users and is the premise for broader acceptance.

Bitgewise files for near ETF to expand institutional access

Bitwise has submitted a brand new application to the beginning of a fund (ETF) traded by Spot Exchange, which focuses on almost protocol. According to the official submission of May 27, 2025, the proposed product should provide institutional and retail investors directly nearby without keeping the tokens directly.

The ETF goals to pursue the worth of just about as precisely as possible by keeping the underlying asset in protected custody. Bitwise confirmed that the fund is kept near tokens with regulated, insured administrators. This registration combines a broader wave of crypto-based ETF applications after the recent permits of Bitcoin and Ethereum ETFs have been approved in vital markets.

Bitwise found that the ETF will improve market access, especially for investors which are limited by regulatory or careful restrictions. The company also emphasized that such instruments can reduce company risks and lower obstacles for institutional entry into the nearby protocol.

While the US Securities and Exchange Commission (Sec) has not yet approved an almost based ETF, this step signals the growing demand for broad crypto engagement through traditional financial products. The application of Bitwise reflects increasing trust within the long-term care and infrastructure of close-up, especially after the most recent upgrade from Nearcore 2.6, through which global contracts were introduced.