Between April 23 and May 23, 2025, the SUI/USDT pair rose by 97.96%and rose from USD $ $ 4.3299. The sharp rally lasted 32 days and, based on the TradingView data, provided a complete volume of two.88 billion USDT.

Suiusdt 1d price diagram. Source: tradingview.com

However, the rally lost the strength after reaching the tip. After the climax, the value began to consolidate in a narrow area. Sui is currently coping with around $ 3.6865, which highly indicates a decline in comparison with the youngest.

The 50-day exponential sliding average (EMA) has risen to USD 3.3556. The price is now above this moving average, which indicates that the short -term bullish impulse remains to be valid. However, the withdrawal of lower than 4.00 US dollars shows the growing resistance at higher levels.

If Sui doesn’t keep the EMA as support, this might visit the zone of USD 3.35 to three.10. The move from $ 2.18 to over $ 4.32 marks an almost double profit, however the sellers start under pressure to purchase buyers near the resistance. The trading volume also appears to be rejuvenated after the height and signal the cooling interest.

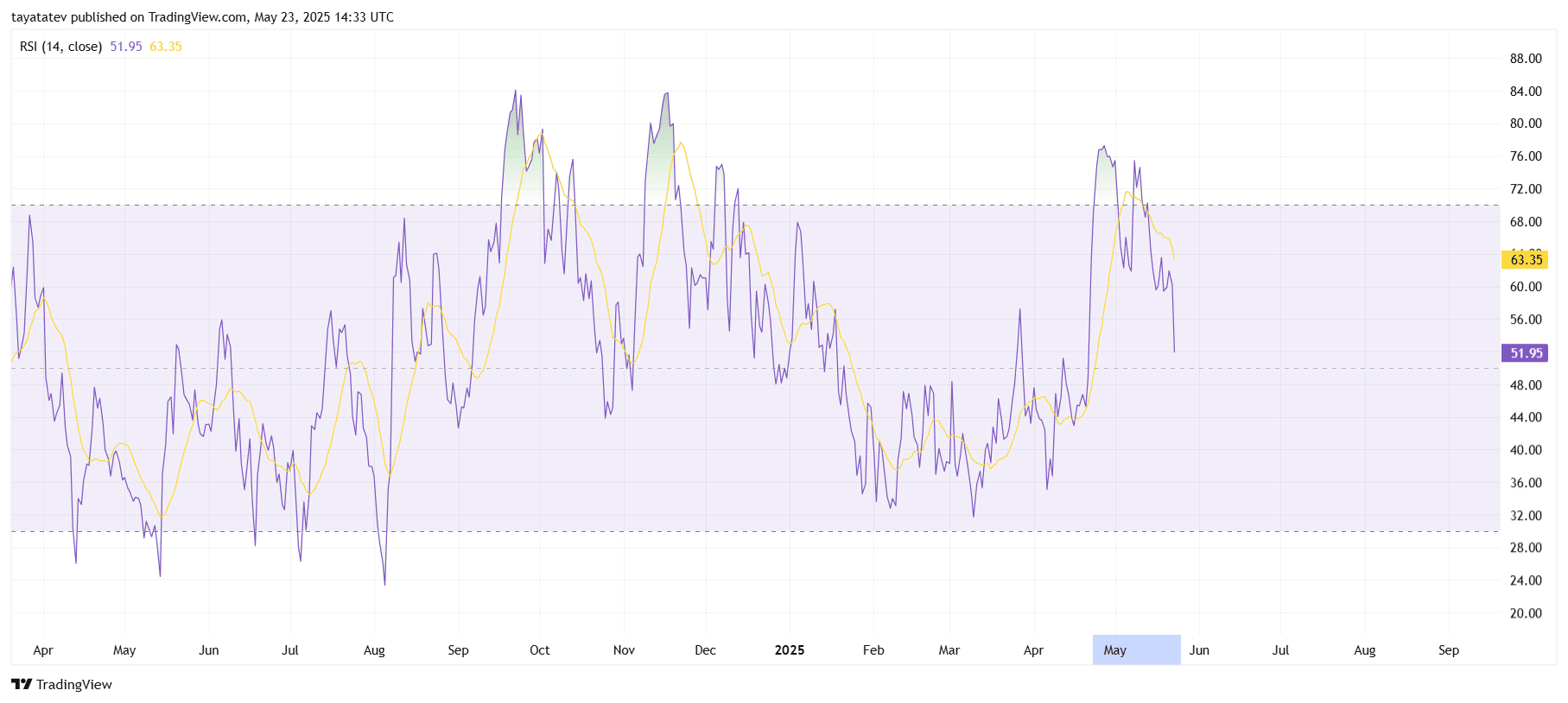

Sui RSI falls under 52 after mid -May

On May 23, 2025, the relative strength index (RSI) for SUI/USDT fell to 51.95, based on the 14-day RSI indicator. So far, the RSI has reached near 73 at first in May and signaled overhanged conditions at the moment. Since then, the indicator has dropped steadily and shows a weak dynamic.

RSI (14) every day diagram for Sui/USDT. Source: tradingview.com

RSI (14) every day diagram for Sui/USDT. Source: tradingview.com

The RSI -gliding average (yellow line) is currently 63.35. This gap between the RSI and its average indicates short -term bear divergence. While the RSI stays above the neutral 50 line, the downward tendency reflects the fading of the acquisition pressure.

At the identical time, the RSI curve shows a robust decline and has marked the strongest correction of the impulse since March. If the RSI falls under 50, this may confirm a shift to a neutral or bear -of -bear phase. For the time being, the index is situated directly above this level and indicates uncertainty.

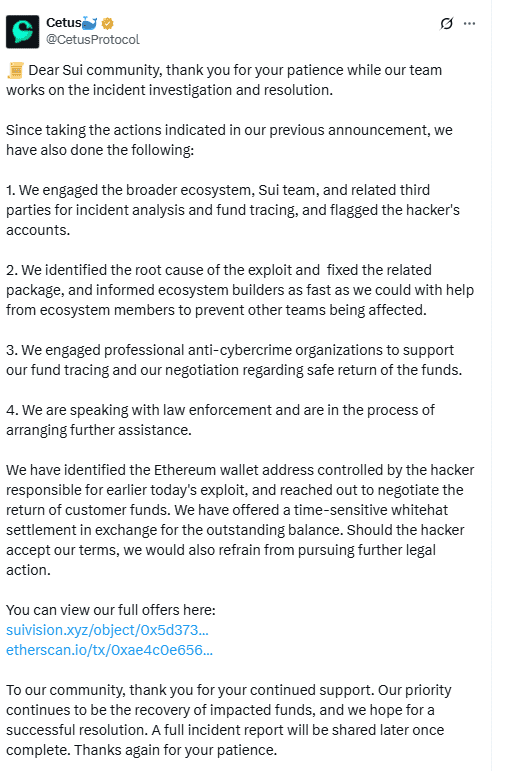

On May 22, 2025, the Cetus protocol within the SUI network suffered a serious security violation. The attacker used the protocol and steel 260 million US dollars of crypto assets. This forced cetus to pause its intelligent contracts and spend a white offer to the hacker.

Cetus Protocol declaration of USD 260 million exploit. Source: X (@cetusprotocol)

Cetus Protocol declaration of USD 260 million exploit. Source: X (@cetusprotocol)

The Sui blockchain, which houses the protocol, allowed freezing transactions. This campaign has sparked concerns about SUI decentralization. Critics say that the incident shows how much control the network operators have.

The Cetus Hack has now change into certainly one of the largest attacks on the SUI network since its start.

Critics say that the SUI decentralization is misleading

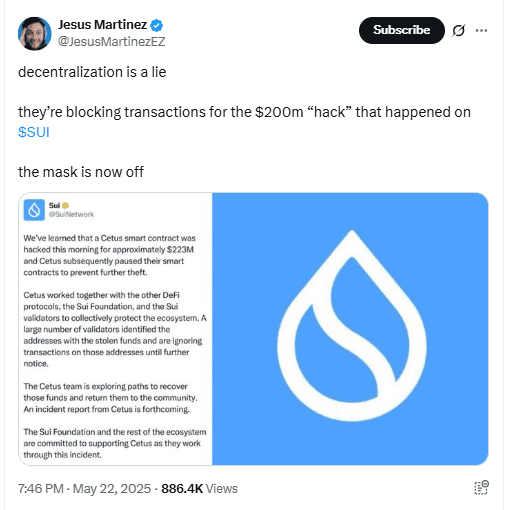

After the Cetus -Hack, several industry voices questioned the decentralization of the SUI network. Jesus Martinez, founding father of Legion, addressed himself directly on social media. He said:

“Decentralization is a lie. They block transactions for the 200 million dollar -hack that happened on SUI. The mask is now over.”

Jesus Martinez criticizes Sui about Cetus -Hack. Source: X (@jesusmartinezez)

Jesus Martinez criticizes Sui about Cetus -Hack. Source: X (@jesusmartinezez)

The comment gained traction on the crypto community. It triggered one other test for the structure and Validator governance from Sui Blockchain.

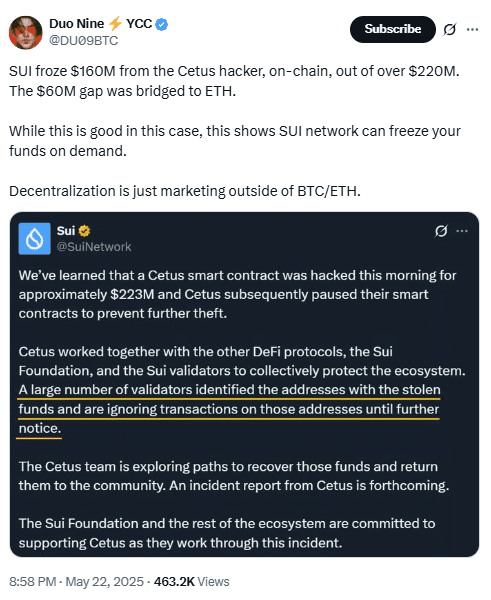

The duo nine, the founding father of YCC, identified that freezing funds may also help prevent losses, but it surely shows that the SUI network can overwrite transactions. He explained:

“Although this is sweet on this case, this shows that SUI network can freeze its funds if crucial.”

Duo Nine says that Sui Network freezes funds on Demand. Source: X (@du09Btc)

Duo Nine says that Sui Network freezes funds on Demand. Source: X (@du09Btc)

Duo Nine also found that real decentralization outside of Bitcoin and Ethereum is rare. The cetus hack added to those doubts how decentralized the Sui blockchain really is.

Token Control and Validator Power increase red flags

In 2024, Cybercapital Cio Justin Bons claimed that the founders of SUI controlled 84% of the desired tokens. According to him, such control enables network manipulation.

According to the Cetus protocol, the BONS actively censored the hackers' transactions. He wrote:

“Suis Validators are only colliding to censor the hacker's TXS! Makes the SUI centralized? The short answer is.”

He added that the validator within the SUI network is barely 114. Bons argued that with so few validators and high token ownership, decentralization was difficult to attend.

The SUI developers denied the control of investors or finance token. Nevertheless, the token concentration after the 260 million dollar -hack stays a vital problem with the critics.

Past incidents show central control over blockchains

The Cetus hack isn’t the primary time that a network lasted after a violation of activity in activity. The DAO attack by Ethereum 2016 led to a tough fork that Ethereum Classic created. Solana was previously based on validators to coordinate silent corrections for a token exhibition error.

Bitcoin also looked a critical inflation error. The developers tacitly turned to large mining pools to spark the issue before they publicly announced it. The response of the Sui Blockchain to the Cetus -Hack now follows similar control patterns.

Other examples are Tether freezing of billions of dollars to support criminal prosecution and Thorchain, that are related to the laundry of funds from Bitbit and Coinbase.

In these cases, a recurring problem within the crypto area is highlighted. Projects that prevent attackers are sometimes suspended. Projects that don’t intervene in an effort to lose users.

The debate about SUI validators and the blockchain control are strengthened

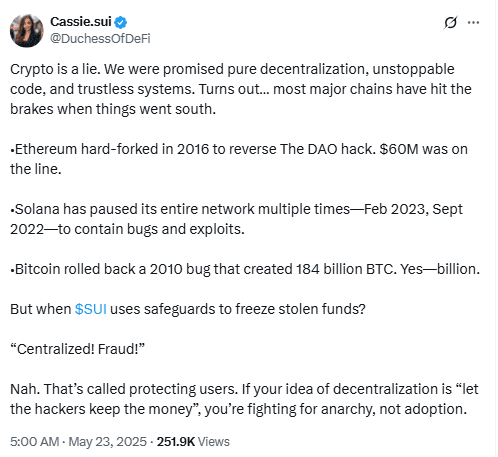

Cassie.sui, an investor, reacted to the Cetus hack by criticizing the guarantees of the blockchain industry. She wrote:

“Crypto is a lie. We were promised pure decentralization, unstoppable code and trustless systems.”

Cassie.sui defends the anti-hack measures of Sui Network. Source: X (@duchessofdefi)

Cassie.sui defends the anti-hack measures of Sui Network. Source: X (@duchessofdefi)

Gautham, co -founder of Polynomial, said that each side of the talk have one point. He added:

“The crypto world is shared.” If you may freeze funds, is it really decentralized? 'Vs. “You have permanently stolen $ 162 million.”

The Cetus -Hack within the SUI network has again put the validator behavior and the token concentration within the highlight. Questions in regards to the role of central control in blockchain systems that claim to be decentralized.