Huma Finance, a comparatively latest project within the Defi sector, claims to not create a protocol for lending against income flows outside of chains, not against crypto security. The project operates Solana and combines fiat-based money flows akin to invoices, salary statements and subscriptions for liquidity providers on chains. The model offers lenders with a set persuasion in real payments and never the speculative lever grinding.

Binance Alpha Start: Limited Float, High expectations, Dao Backs Huma: What dealers should see next

Since the beginning of Huma 2.0, the protocol has received a cumulative payment volume of over 4 billion US dollars and lively deposits of greater than $ 100 million. According to reports, sales from transaction fees are reported by over 9 million dollars. Huma's primary asset is the PayFi strategy token (PST), a Solana-Native earnings application instrument. Two plug-in tracks and maxi drawing between 10.5% and variable “springs” multipliers, that are covered by a deposit of $ 100,000 per wallet.

The team developed the project of the project to maintain and reward the distribution of governance. The total offer is 10 billion, with 17.33% firstly. The assignments include 31% for ecosystem incentives, 20.6% of investors, 19.3% for team and consultant and 11.1% for the Ministry of Finance. Huma added 0.5% of his token supply to a Kaitoai campaign. Binance announced vital figures, however the project has not published an entire calendar, making uncertainties about future unlocking pressure.

The latest developments include the Solana-based 2.0 upgrade, a brand new campaign to reward users and a Jupiter-Dao proposal. However, the next is the choice of Binance to indicate Huma on his Alpha platform, followed by a spot list on May twenty sixth.

Binance Alpha Start: Limited Float, high expectations

Binances Alpha Launchpool list of Huma is a very important liquidity event. The platform began to just accept on May 23 BNB, FDUSD and USDC for agriculture. By May 25, 250 million tokens – 2.5% of the offer – until May twenty fifth. Distribution proposals BNB -Stakers who receive 85% of the every day rewards. There is not any individual item of containers. The design promotes short -term participation of liquidity, but doesn’t limit any whales to dominate the reward distribution.

Huma's complete spot list from Binance is planned for May twenty sixth. Trade pairs include USDT, USDC, BNB, FDUSD and experiment. The list bears the “seed” day and shows an increased risk and the status of the early stage. Binance doesn’t calculate a listing fee.

Binance shared news concerning the introduction of Huma Finance in his launch pool.

The alpha phase includes Airdrops about Binance's “Alpha Points” mechanism. Huma is faraway from the alpha interface after the beginning, and Balden are transferred to predominant national accounts. Dealers should expect thin liquidity in the primary 48 hours, followed by high volatility when the agricultural rewards are activated.

No CEX has confirmed additional lists outside of Binance. However, Huma has set liquidity for Solana-native protocols, including Meteora, Jupiter, Kamino and Ratex. These platforms can host early Dex pairs as soon as tokens will be transferred to the TGE. The decentralized strategy complements the CEX rollout, but doesn’t reduce the risks of aggressive initial speculations and low swimmers.

Solana's role here is structural and never promoting. The speed and the low fees of the chain correspond to the microtranschaft base, akin to. Humas Solana use is significant, even though it is secondary from the perspective of the worth formation from the bony event.

Jupiter Dao supports Huma: What dealers should see next

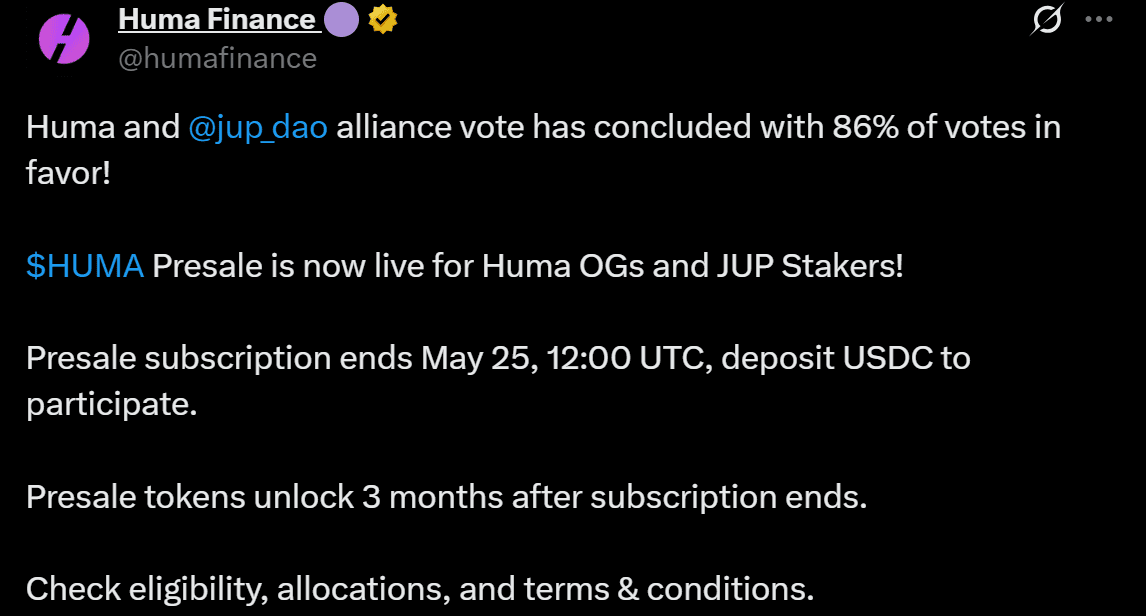

Huma's proposal to Jupiter Dao, which was submitted on May 14, was supported with over 86%. It comprises a 100 million human advance (1% of the offer) for JUP Stakers with an FDV-US $, a treasury exchange of $ 250,000 and a standard community initiatives.

The pre-sale, which is evaluated by over 50% under Humas Serie A, offers a 3-month lockup. It combines Humas Payfi protocol and the liquidity infrastructure of Jupiter. For Huma, integration extends access to the Solana user base and increases the routing compatibility. For Jupiter DAO, it adds an actual payment protocol to the state treasury.

Jupiter Dao approved the alliance with Huma Finance, pre -sale, now until May twenty fifth.

Jupiter Dao approved the alliance with Huma Finance, pre -sale, now until May twenty fifth.

After the rise, each teams began integrating liquidity pools and user-onboarding processes. The Ministry of Finance and Advance sales aim to align the incentives and improve the token distribution without relying exclusively on centralized stock exchanges.

Humas Tokenomics continues to be missing an entire calendar. At TGE, 17.33% of the offer occurs. Team and investor allocations remain under structured lockups, but further transparency for activities continues to be pending. Dealers should monitor this rigorously.

The approval of Jupiter Dao strengthens Humas Solana positioning. It extends the liquidity paths and improves the ecosystem. The success of the mixing depends upon how effective huma controls the transaction volume and the user loyalty within the upcoming quarters.