Solana (Sol) formed a bullish flag pattern within the 4-hour table, which was confirmed between May 13 and May 19, 2025. After a pointy upward movement, a bullish flag appears, followed by the consolidation of the downward lock inside parallel lines, whereby the signals often continued upwards.

Solana Bullish Flag pattern. Source: tradingview.com

The price broke out of the flag on May 21 and rose by almost 10%, then withdrew 5% to check the support of the exponential average of the 50 periods (EMA) near $ 173.13.

Sol is $ 177.28 by May twenty fourth and lasts over the EMA and inside the breakout zone. The relative strength index (RSI) is 59.76, still in a bullish area, shows a slight decline within the impulse.

If the bullish flag confirms with a powerful sequel, Sol could increase by 24% from the present price and achieve the projected goal of USD $ 220.01, as Coinchapter previously reported.

The price structure, the quantity support and the holding EMA suggest that the bullish outlook stays intact, unless sol closes inside the flag.

Kalshi adds Solana inserts, expands the SOL utility and liquidity

In the meantime, Kalshi enabled Solana (SOL) to begun on May 23, 2025, and added the Altcoin next to Bitcoin, USD Coin (USDC) and WorldCoin to his US regulated prediction platform. With the update, users can finance Kalshi accounts directly with Sol and the should be converted into stable coins.

Kalshi confirms the support of Solana with Meme Post. Source: Kalshion X

Kalshi confirms the support of Solana with Meme Post. Source: Kalshion X

With this integration, Sol owners can now enter predictive markets with their native token. This change increases the token cycle via wallets and Kalshi, which can increase demand on chains.

In the meantime, Solana's activity focused on the chain around decentralized Exchange (Dex) and Meme-Münz speculation. In May 2025, Mememen coins made almost 65% of the network's trading volume, whereby the day by day Dex turnover reached a high point over $ 45 billion. Kalshi is now adding a brand new application: event -based predictions. Users can set them on topics similar to weather, elections and even entertainment events similar to a GTA 6 version.

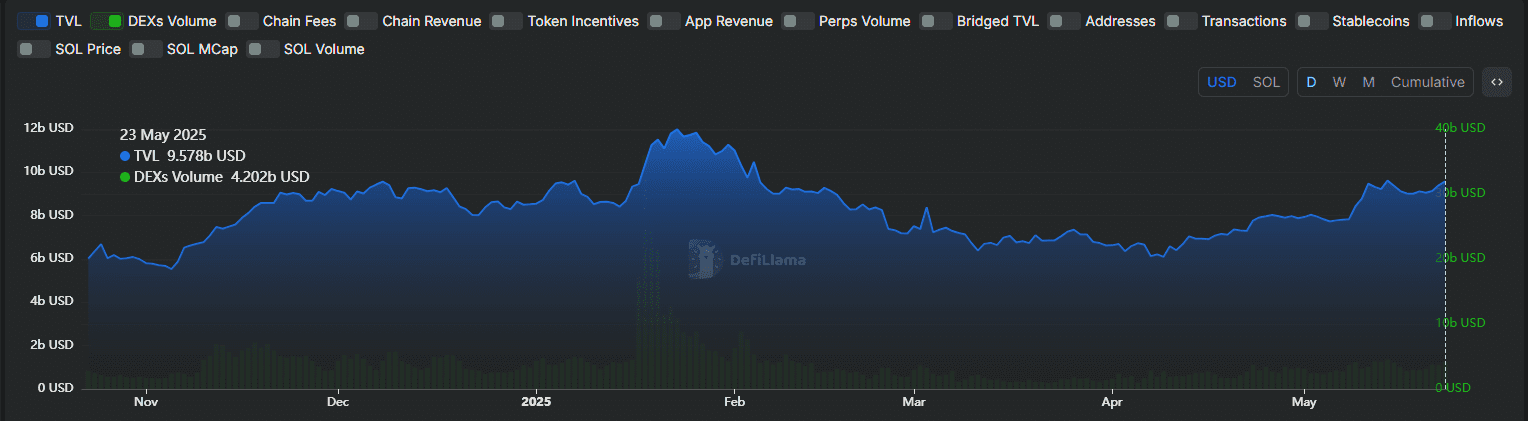

Solana TVL and Dex volume tip in front of the Kalshi integration. Source: Defillama

Solana TVL and Dex volume tip in front of the Kalshi integration. Source: Defillama

As a result, Sol can see a wider utility beyond Defi. The funds blocked in event contracts will again enter the Solana ecosystem and improve the depth of the market.

The SOL integration of Kalshi also uses zero hash to robotically convert deposits into US dollars. This setup lowers the comparison frame and the appeal to crypto-native dealers who strive for a fast execution and low fees.

In addition, the move can increase the range of Kalshi. The platform edited the trading volume of 1.97 billion US dollars in 2024, in comparison with $ 183 million within the previous 12 months. It now serves users in over 40 US states and has recently began a mini app for WorldCoin users.

Solana's presence on Kalshi complements his existing role in Polymarket, a decentralized predictive platform that also uses the Solana blockchain. The double list could mix crypto native and controlled markets, expand liquidity channels and create a bridge between ecosystems.

Polymarket against Kalshi market statistics comparison. Source: Polymarket Analytics

Polymarket against Kalshi market statistics comparison. Source: Polymarket Analytics

Solana desires to “make everyone an investor,” says the NCMO of the inspiration of the inspiration

Akshay BD, the Non-Chief Marketing Officer (NCMO) on the Solana Foundation, said Blockchain could help fix essential problems in today's economic system. At the Accelerate 2025 conference, he claimed that Solana's technology could “turn into an investor or dreamer over time”.

Akshay argued that the present economic system doesn’t serve most individuals. He identified increasing concerns of investment managers and customers.

“They have low bond returns, financial bubbles and confusion about how conventional portfolios work.”

he said.

“The 60-40 model not worked for a very long time.”

According to him, the gap grows between wage income and the wealth relationship. Most retail investors cannot access private markets which might be normally reserved for accredited investors. As a result, public markets often should overheat as a consequence of limited alternatives.

https://www.youtube.com/watch?v=QLBCVTIAPNI

Tokenization could fix owner gaps

Akshay presented the thought of the “universal property”. Instead of counting on welfare programs similar to the Universal Basic income, he suggested using blockchain in an effort to grant every access to wealth conditions.

“If you’ve a cellular phone, you must have the option to own something”, “

he said.

In his view, tokenization could enable people to speculate in energy corporations and even in local cafes – only by scanning a QR code. Solana's infrastructure could enable this vision by reducing the entry barriers for normal users.

At the identical time, Akshay warned that artificial intelligence could increase inequality. If AI takes over jobs and drives capital to fewer hands, individuals who haven’t any assets can fall back. In this context, the expansion of property by crypto could offer an actual alternative.

Retail investors are excluded from high -quality markets

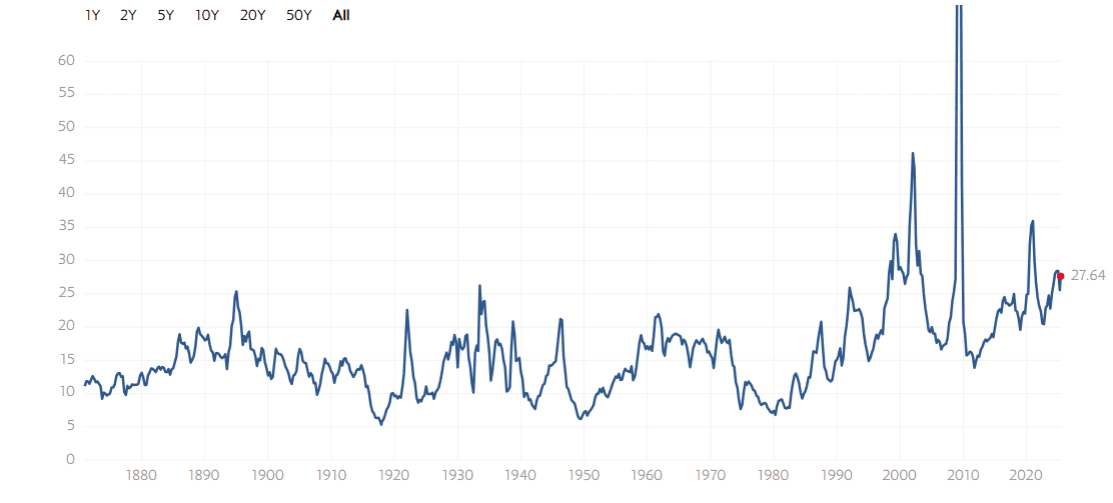

According to Akshay, the present market dynamics have smaller investors. Public stocks have been overrated for years. The market evaluation company Multpl shows that the price-performance ratio of S&P 500 has remained over 19.6 over 19.6 since 2018. This is well above the historical average of 16.1.

S&P 500 P/E ratio trends since 1870. Source: Multpl.com

S&P 500 P/E ratio trends since 1870. Source: Multpl.com

These high rankings reflect low rates of interest, strong company results and technical optimism. But additionally they increase risks. Last overview periods led to sharp corrections similar to the DOT COM crash and the subprime crisis from 2008.

Akshay said earlier attempts to democratize investments didn’t work since the technology was not finished. However, Blockchain now enables latest opportunities to “finance all productive assets within the economy”. With Solana, he said: “Anyone who contributes to the economy may also have a part of it.”

He described Crypto as something that “starts with the sport and quickly becomes profound”. In short, Solana desires to have the property of assets in a universal experience – one wherein scanning a code could make you a stakeholder.